ArborCrowd is the first Real Estate Institution to launch a Crowdfunding Platform, opening up our exclusive network to a new class of investors.

ArborCrowd offers our investors exclusive access to our institutional quality investment opportunities. Our origins and participation in The Arbor Family of Companies, a highly regarded commercial multifamily real estate investing and lending institution, mean every deal is thoroughly vetted to achieve optimal returns for our investors. We focus on key high-growth and resilient areas of the real estate sector.

The combination of historically low housing supply and strong demographic-driven demand—with added pandemic-driven tailwinds—has sent single-family demand and rent growth soaring at the fastest rate on record. The single-family rental (SFR) asset class is among the fastest growing property type for institutional capital, with investments in the tens of billions since March 2020. ArborCrowd selects fully optimized SFR and build-to-rent (BTR) investment opportunities that are developed and managed analogous to an investment-grade apartment community—featuring attractive branding, consistent quality, design, and efficient operations, and positioned to meet market demand for maintenance-free, single-family living.

ArborCrowd brings to our investors highly curated multifamily development and acquisition investment opportunities designed to deliver attractive risk-adjusted returns. According to the NAREIT index, the multifamily sector has consistently outperformed other commercial estate segments, including industrial, office and retail. All ArborCrowd investment opportunities are professionally managed apartment communities in markets with strong fundamentals that have been extensively vetted by our seasoned real estate underwriting team. ArborCrowd serves as the Asset Manager on behalf of our investors to oversee deal execution and ensure long-term performance.

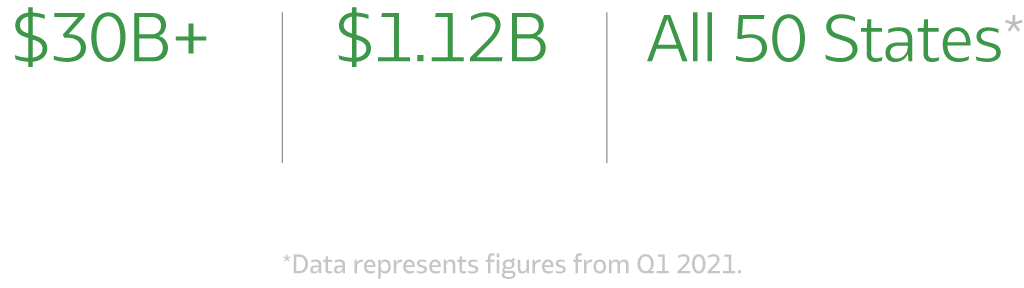

ArborCrowd is part of the Arbor Family of Companies which includes Arbor Realty Trust, a publicly traded real estate investment trust (REIT).

ArborCrowd is part of the Arbor Family of Companies which includes Arbor Realty Trust, a publicly traded real estate investment trust (REIT).

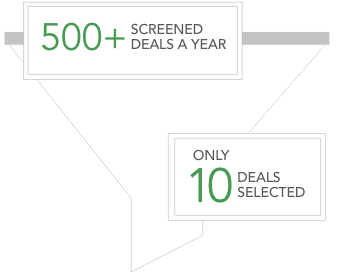

ArborCrowd hand selects every deal from The Arbor Family of Companies’ proprietary network, and choose the ones that survive our rigorous underwriting process.

Our thorough offering materials are there to help investors make the most informed decisions.

We founded this platform to give individuals who previously did not have access to commercial real estate opportunities the ability to invest in institutional-quality investments.

Following the passage of the Jumpstart Our Business Startup Act of 2012, we realized the industry was moving in this direction and we plan to stay ahead of the curve to benefit this new class of investors.