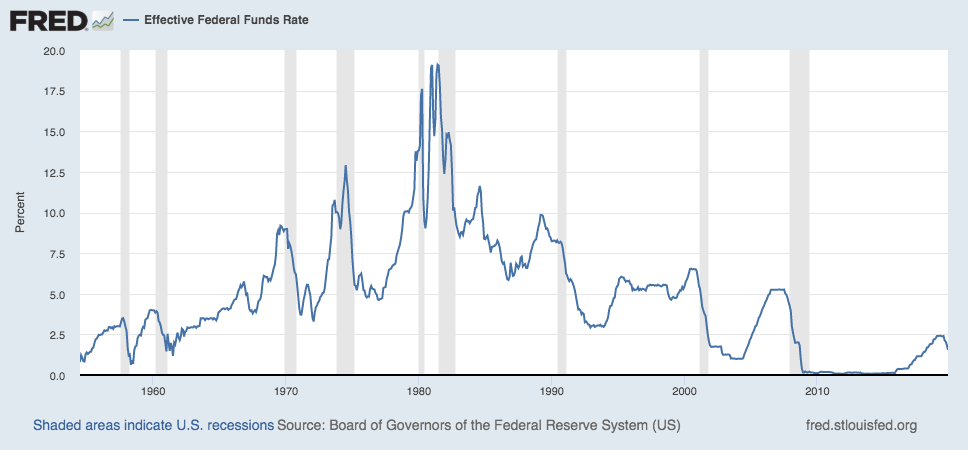

Over the past year, U.S. interest rates reverted to near historic lows, as the Federal Reserve System reduced the benchmark interest rates three times to bolster the economy and mitigate global and domestic financial risks.

Those actions are likely to breathe new life into the commercial real estate industry as lower interest rates often have widespread impacts on purchases, sales, investments and financing.

When the Federal Reserve lowers interest rates, it directly impacts the interest rates charged by lenders on commercial real estate loans. Lower loan interest costs can make deals more attractive to real estate purchasers because the reduced monthly debt service frees up cash flow generated from the property for other uses, such as property improvements and investor returns. Ultimately, this can translate into an increase in real estate activity as deals that previously did not pencil out with strong yields for purchasers suddenly become appealing merely due to the lower expenses afforded by lower interest rates.

Lower interest rates are also good for sellers of real estate, because more purchasers trying to take advantage of the low rates can translate into multiple offers for a single property, driving up the value.

Another beneficiary of lower interests rates are owners who have no immediate plans to sell their assets. These owners may have the opportunity to refinance their existing mortgages with new loans with lower debt service payments, which can free up cash flow that can be paid to investors, oftentimes resulting in higher than projected returns. It is a common practice in real estate to acquire property with a short-term “bridge” loan, which typically carries a higher interest rate than longer term financing. Once the property has been renovated, rents have been increased and occupancy is stable, the bridge loan is refinanced with permanent financing. When interest rates fall after the bridge loan was obtained and the new loan is closed, this can result in a windfall for property owners.

Investors can also benefit from a low interest rate environment in multiple ways. Deals that they are already invested in may sell sooner than anticipated and for higher sale prices, resulting in higher returns. Additionally, the greater deal volume generated by lower interests rates means more equity will be needed to close on these deals. Ultimately, this can mean a mutltiude of investment opportunities to choose from. With the ever increasing popularity of real estate crowdfunding, expect to see more real estate sponsors using crowdfunding as a way to raise equity for their transactions.

Since the Great Recession, the U.S. economy has been on the longest expansion in the nation’s history. Real estate investment activity dramatically increased and as a result, values rose sharply. As entry prices into properties increased, it became more challenging for real estate companies to find deals with higher yields, causing compression in returns for new opportunities. But thanks to lower interest rates, the real estate investment market could see another leg to its bull run.

A word of caution should be noted. There are many factors that determine the success of a real estate project, and lower interest rates by itself does not mean that a deal will be successful. Conversely, good deals can still be found even in a higher interest rate environment. That’s why it’s still necessary to focus on strong fundamentals and to ensure that you are investing with an experienced team that takes a measured approach to underwriting real estate transactions.

We invite investors to contact us to learn more about the rigorous standards we implement in our underwriting process. Please feel free to email at [email protected] or call 844-365-1200 to speak to a member of our team.