There’s a lot to consider when investing in commercial real estate and one shouldn’t go in blindly. A savvy investor will do his or her homework and understand the choices available for developing a strong investment strategy.

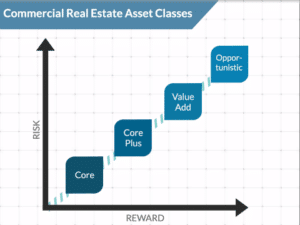

Though every investment opportunity is unique depending on the location, property type, market fundamentals and business plan, there are four main categories of investments to be aware of — Core, Core-Plus, Value-Add and Opportunistic. Each offers its own pros and cons, though you are more likely to come across Value-Add and Opportunistic deals in the crowdfunding space.

A well-balanced commercial real estate portfolio might contain a mixture of some — or even all — of these different investment categories depending on the risk tolerance of the individual investor.

Below are some of the basics of what you should know about each of these four investment strategies.

Core

Core investments are fully stabilized properties. For an office, industrial or retail property, that means credit quality tenants on long-term leases. A Core residential property could be a recently developed luxury apartment tower with low vacancy located downtown in a major primary market.

Core investors are classified as those who favor yield over appreciation and view real estate as a relatively safe place to invest capital. Institutional investors sometimes favor these acquisitions in order to generate a reliable, conservative return.

Many are low-leverage trophy office properties situated in the central business districts (CBD) of major metro areas, such as Chicago, D.C. and Manhattan. These properties are most likely well kept, in solid condition and require little to no improvements.

A large percentage of these properties are national franchises supported by guaranteed rents from the parent company, helping to add an additional layer of security for any investor.

Experts liken the investment approach to investing in bonds, although there’s an added benefit of having a physical asset to back it up, and they also provide a better hedge against inflation. Additionally, Core investments have historically been most liquid than some of the other asset classes due to the fact that they are stabilized, attractive, well-located and marketable assets. With Core investments, returns are normally 6 – 11% IRR.

Core-Plus

For those investors who are looking for a safe return, but also seek a little bit of an upside opportunity, Core-Plus investments might be the way to go.

While similar to Core investments, a Core-Plus property has a bit more opportunity to increase Net Operating Income (NOI).

For example, a Class A office building located in the CBD of a primary market would be classified as Core-Plus if there were several expiring leases on the books. Whereas Core investors might see a pending lease roll as a threat to future income, Core-Plus investors view this as an opportunity to increase rents and add value.

Additionally, a Core-Plus property could have some vacancy, may need some renovations. Or perhaps the credit ratings of some tenants may be low. These problems can be fixed over time from small operational and physical adjustments.

Investors pursuing a Core-Plus strategy will purposely find properties that are fundamentally sound and appealing, but offer a better chance of enhanced returns. While returns will vary, most analysts peg this investment at around 9 – 12% IRR.

Value-Add

Sometimes a name says it all. That’s the case with Value-Add investments. This asset class is for investors looking for opportunities to increase the value of their commercial real estate (CRE) investments by adding to or enhancing the properties.

Value-Add investment opportunities display a desirable balance of risk and reward for the average investor.

This investment approach was the most popular in 2016, with more than half of all private equity real estate investors pursuing these opportunities. This was especially true for the multifamily sector. With the lowest homeownership rates in decades, the demand for quality apartment properties is at an all time high in the U.S. With an aging apartment stock, there are plenty of opportunities to find older, underutilized multifamily properties. Sponsors renovate and upgrade property management to unlock hidden NOI, which is passed on to crowd investors.

Value-Add investments can be found in primary, secondary or tertiary markets, and these properties will normally show a higher vacancy rate or some physical obsolescence. This means investors can buy these properties at a substantial discount, and then work to increase the occupancy or fix any physical deficiencies that are present. After a property has been stabilized, they are often sold in the Core category.

Someone who acquires a Value-Add property will most likely have a specific business plan in place designed to improve the under-utilized asset. This can involve either physical or operational improvements, and typically includes a mixture of both.

For example, an investor might buy a distressed apartment property in Nashville. The seller had not been providing adequate repairs. Vacancy and rent rates suffered as a result. The new owner will come in — and over the course of 2 to 4 years — complete deferred maintenance, renovated outdated units (often with a focus on bathrooms and kitchens), and release units at market rate rents. Once the asset’s occupancy and rent rates are in line with comparable products, the seller decides to sell.

Or our Value-Add investor could buy a shopping center that has an empty anchor slot, which would lower the price of the asset. That buyer can then fill the space and improve the overall property value.

Unless something dreadfully goes wrong with the renovations or market, the investment should yield a nice return. Value-added investors typically look to hold an asset for 2 – 7 years, and investment returns can range in the 12 – 18% IRR.

Opportunistic

With Opportunistic investments, the goal is for the investor to take an entrepreneurial risk to achieve out-sized returns. With that in mind, there are numerous types of asset investments that fall into this category, including ground-up developments, adaptive re-use, and emerging markets. Opportunistic strategies may also involve acquiring foreclosed assets from banks.

Generally, these properties are generating very little or no cash flow, and are highly leveraged, making them a riskier proposition than Core, Core-Plus or Value-Add.

An investor who chooses this route will have to see the big picture and bank on the future of the asset, as the profits will come from future rental income or the sale or refinancing of the asset once the market improves.

The typical asset is held longer than value add, 3-7 years, for example. While there is more risk to the investor, the overall returns can register at 18% or higher — so the potential reward is greater as well.