Where do Single-Family Rental and Build-to-Rent Developments Make Sense?

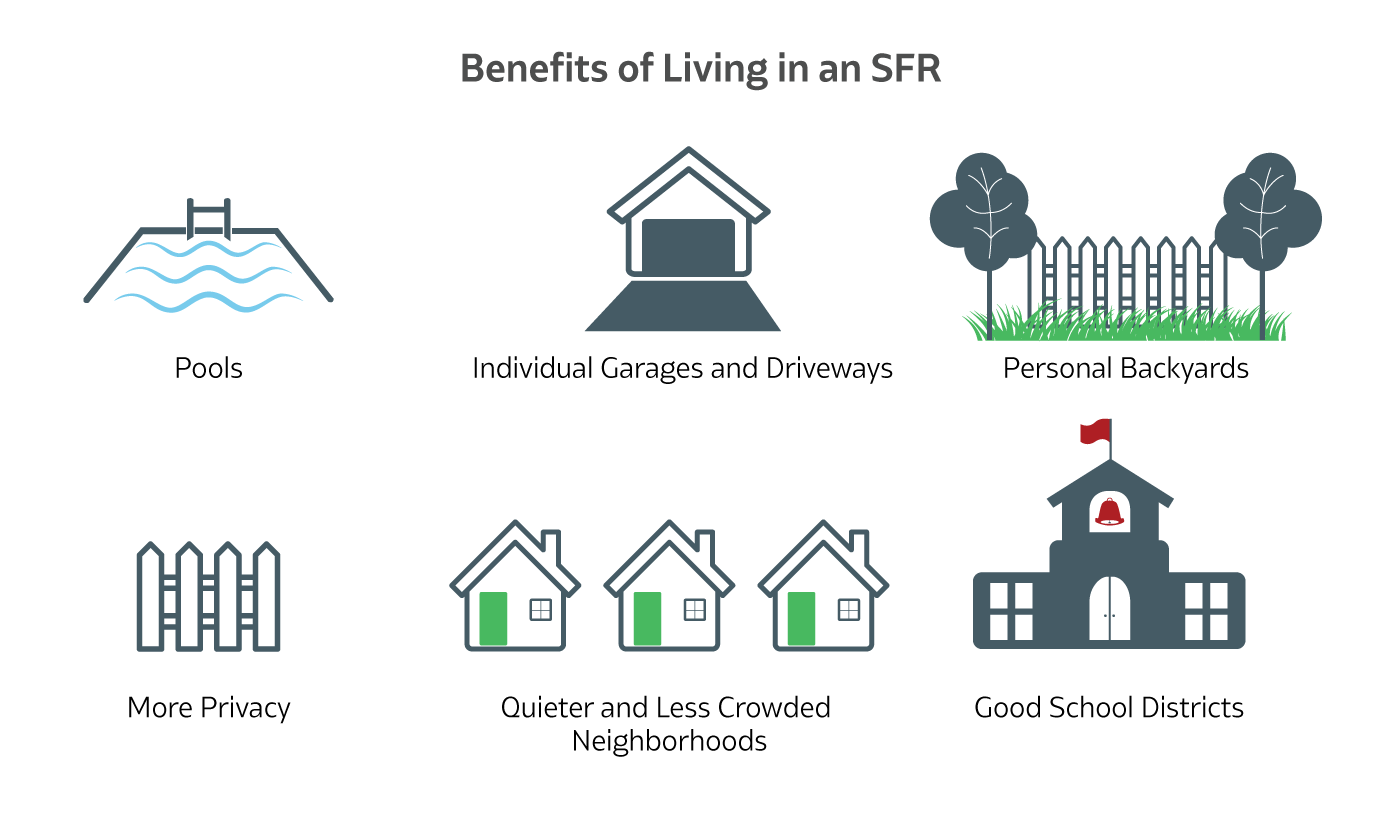

Single-family rentals (SFR) and built-to-rent communities (BTR) have surged in popularity for reasons that include changing demographics and increased costs of homeownership. For many, the combination of having the privacy and space of an entire home with the flexibility and affordability of renting is a draw that is too hard to pass up. Investors have taken notice of this trend and are pouring capital into this newer subset of the multifamily real estate asset class.

SFRs and BTRs can be found in many markets across the country, but not all markets are conducive to these types of properties. A number of factors play into the viability and attractiveness of a location for an SFR development, such as:

- Availability of raw land at a feasible cost

- Market demand and demographics to support SFR and BTR

- Accessibility to amenities and employment centers

Availability of Raw Land at a Feasible Cost

Creating a single-family or built-to-rent development requires a large portion of land often ranging from 25 to 75 acres, depending on the style of homes and number of units. Additionally, after identifying the availability of the land, the sponsor must be able to secure it at a cost that makes financial sense. The land cost in the overall development budget can ultimately determine whether or not the deal is financially feasible and supportable by market rents. Since SFRs and BTRs require more land area per unit to build than say a mid-rise or garden-style apartment community, the ability to acquire land at a reasonable cost is an important component of the development process for deciding to build a new SFR or BTR community over another kind of asset class.

For this reason, it’s less common to find SFR developments in areas such as New York City and San Francisco, for example. These areas have denser populations, less open land to build on, and are generally too expensive per unit to make an SFR project viable. Instead many SFR operators have been targeting cities in the Sun Belt region – the southernmost region of the country that stretches from California to North Carolina – as there is more land to build on and the area is typically less expensive.

Market Demand and Demographics to Support SFR and BTR

In order for a real estate project’s income to support the cost of development, there needs to be ample demand for the types of units being built, which can be ascertained through due diligence of the area’s demographics.

SFR and BTR communities are more attractive to younger generations like millennials who are starting families and have the need for larger units, and desire suburban amenities.

While some millennials may prefer owning a home to start their family, it may be challenging to do so today. The barriers to entry for homeownership have become very high, and many younger families still do not have the savings to afford a down payment and closing costs. Since the Great Recession in 2008, home prices have steadily increased each year, and continue to set new highs.

For other households, homeownership may be an issue because of the need for flexibility. A home is generally the largest financial asset an individual or couple may own, and given its illiquid nature, owning can tie up cash that may be used for other purposes or set aside for an emergency fund. Additionally, some families prefer the ease of renting and being able to move without being locked into one location.

Single-family rentals and built-to-rent communities are a more affordable and flexible alternative to homeownership, and has been a solution for younger families’ needs. Through researching the demand and demographics of various locations, it’s possible to identify a market that is experiencing an influx of young and expanding families, which could be attractive for an SFR or BTR development.

Accessibility to Amenities and Employment Centers

Even though SFR and BTR renters want the size and privacy of a house, they still need to be within reach of urban cores and suburban employment centers. People still enjoy the nightlife, restaurants and cultural aspects of urban life, and they must be within driving distance to their place of employment. However, not all markets have easy accessibility to the urban core from SFR and BTR communities.

For instance, in towns near New York City, it’s not easy for most people to drive to work, so they generally rely on public transportation. However, in many other cities that are not as dense, it can be feasible to drive everywhere, including into downtown areas, as there isn’t the same reliance on public transportation infrastructure.

While investments in SFRs and BTRs continue to increase in popularity, as with every investment, it’s important to ensure that the deal’s fundamentals make economic sense. For SFRs and BTRs, location is of paramount importance to its success. Investing with an experienced partner that understands the nuances of the SFR and BTR product is especially important with this burgeoning asset class.