Commercial real estate investments are consistently ranked among the best long-term investments for Americans compared to stocks, gold, bonds, savings accounts and other investments.

As a tangible asset, real estate has inherent value, and many investors like the security that comes from being able to actually see and touch the investment in person.

Investing in commercial real estate has numerous other advantages that makes it a generational wealth builder, including:

- Cash flow distributions

- Property appreciation

- The ability to use leverage

- Exposure to an alternative investment

- Various tax advantages

- Property appreciation can hedge inflation

This article will explain those benefits, which are just some of the potential pros of commercial real estate investing.

1. Cash Flow Distributions from Real Estate Investments

Real estate investments can generally return money to investors in two ways, through distributions from cash flow and appreciation in property value.

Cash flow is income the property makes minus all expenses and debt service. Income from a commercial real estate property can be derived from various sources to maximize cash flow, including:

- Storage spaces

- Parking lots

- Application fees

- Pet services

- Fitness centers

Cash flow can be distributed to investors in steady payments. Some investors prefer to receive regular income from investments, so this benefit may be attractive to them.

The cash on cash return calculates the ratio of a property’s cash flow to the initial invested capital. This metric could allow an investor to compare a returns from equity real estate investments to other income-producing investments, such as bonds or preferred equity.

2. Real Estate Property Appreciation

In addition to cash flow distributions, some real estate investments may appreciate in value over time and investors could benefit from a return of their initial investment and a capital gain.

In some businesses plans, appreciation could be the main target of the property. With opportunistic deals, the business plan is generally to develop a new property and lease it up. This generates value. If the property is sold for more than the development and operational costs, it will return profits to investors.

In some businesses plans, appreciation could be the main target of the property. With opportunistic deals, the business plan is generally to develop a new property and lease it up. This generates value. If the property is sold for more than the development and operational costs, it will return profits to investors.

Additionally, with value-add investments, sponsors acquire a property and make repairs, upgrades and operational efficiencies to maximize rents, which may increase the property’s value. Investors may receive large gains upon the refinance of a property’s loan after stabilization or a sale of the improved asset.

Learn more about the different types of investment strategies.

3. Leverage: Financing Commercial Real Estate Properties to Maximize Returns

To acquire or improve commercial real estate, sponsors typically borrow money from lenders to execute their projects. This is an advantage because real estate mortgages have cheaper borrowing costs than other kinds of debt, especially in recent years as the Federal Reserve has kept its interest rates to near zero. If executed successfully, an investment using leverage could multiply returns for investors compared to one without financing.

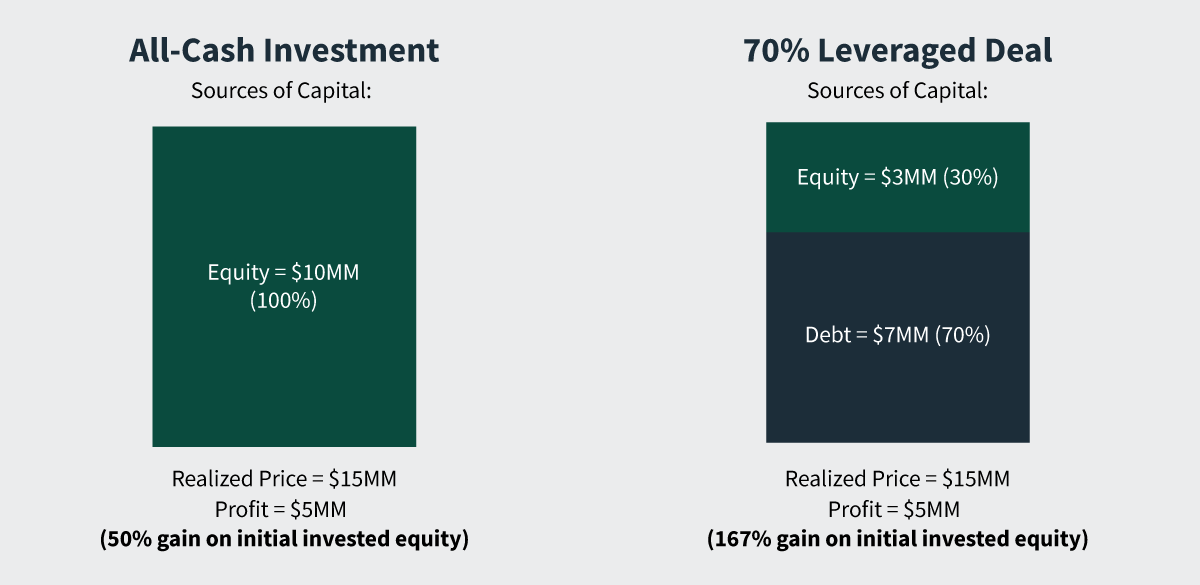

Let’s take a look at how leverage can maximize returns in a simplified scenario where the same business plan is executed with or without leverage:

$10MM Real Estate Investment with Leverage vs. an All-Cash Investment

As shown above, the investor that acquired the property without debt achieved a 50% return on their initial invested equity, while the investor that acquired the same property but borrowed 70% of the acquisition price made a 167% return on their initial invested equity. Obviously, this illustration is highly simplified and does not take into account debt origination and exit costs, or debt service, which would be necessary to pay the loan, and could reduce profits from the leveraged example.

Additionally, the scenario doesn’t take into consideration principal pay down, which could increase the sponsor’s equity stake in the investment over time. While leveraging a property can potentially maximize returns, the cherry on top is it also frees up capital that could be used for another investment. In the scenario above, the investor could have used the remaining $7 million not used in that transaction, to execute another real estate investment.

4. Tax Benefits of Investing in Real Estate

Taxes are an (almost) unavoidable expense when investing in any asset and making a return.

One additional benefit of investing in real estate using leverage is that interest payments on the mortgage could be tax deductible.

Besides interest expense, real estate investments may qualify for and receive numerous other tax advantages, which could result in huge savings to investors and increase returns. Some common tax advantages include:

- Depreciation

- 1031 Exchanges

- Historic Tax Credits

- Tax Increment Financing (TIF)

- Potential Non-taxable Distributions

- Long-Term Capital Gains

- Opportunity Zones

In addition to these benefits, commercial real estate is an alternative investment that is allowed to be invested in by a self-directed individual retirement account (SDIRA). An SDIRA is a tax-advantaged investment account for retirement, where an individual has control to invest their funds in a wider range of asset types than stocks, bonds, mutual funds and ETFs in a traditional IRA. However, funds from an SDIRA typically aren’t allowed to be invested in certain assets.

Learn more about real estate tax benefits with our article on this topic.

5. Alternative Investments Provide Portfolio Diversification

An alternative investment is one that doesn’t fall into the traditional investment categories of public stocks or bonds. Commercial real estate is such an asset, which means that it is typically not correlated to the public market.

By investing in commercial real estate properties, investors get the benefit of diversifying their portfolios from the volatile stock market. Many investors use commercial real estate to mitigate risk so if the stock market isn’t performing well, it may not have as big an impact on their entire portfolios.

Read more about using real estate as an alternative investment to diversify a portfolio.

6. Rising Rents and Property Appreciation Can Hedge Inflation

Inflation is the rise in prices for goods and services over time. Because of the effect of inflation, the purchasing power of currency falls. Investors typically seek assets that can exceed or (at least) keep up with inflation.

During inflationary periods, rents tend to rise and property values appreciate, outpacing the rate of inflation. Additionally, interest on debt payments could potentially be fixed, allowing stabilized costs.

Learn more about how inflation affects real estate.

In Summary

There are many benefits to investing in commercial real estate. These include obtaining distributions from cash flow, property appreciation, the ability to use leverage with low borrowing costs, exposure to an alternative investment, and various tax advantages.

Crowdfunding platforms like ArborCrowd are breaking traditional barriers for retail investors to access the benefits of commercial real estate investing. Learn more about how real estate crowdfunding is different.