Investing in Institutional Quality Real Estate

Institutional quality, or institutional grade real estate, generally refers to commercial real estate of such size or quality that it is exclusively accessible to institutions such as hedge funds, endowments, pension funds, investment banks, REITs, or ultra-high net worth individuals.

However, the 2012 Jumpstart Our Business, or JOBS Act paved the way for individual investors to easily access more institutional quality investment offerings. When it comes to real estate, the law accelerated a boon in novel means of diversification into the commercial real estate market. Real estate crowdfunding emerged, an easy to access form of real estate syndication, quickly growing into a multibillion-dollar industry.

Through a powerful online platform, ArborCrowd brings quality institutional real estate investment opportunities to accredited investors. Through the crowd, retail investors today have unprecedented access to high-caliber investments once relegated to institutional investors with the knowledge, networks, and capital.

However, as more online platforms, portals, and marketplaces emerge to grant a new class of investors unprecedented access to new investment vehicles, it’s important to consider what makes a real estate investment “institutional” quality — and a cut above the rest.

Institutional Quality Real Estate Crowdfunding

Historically, institutional investment properties were out of reach for individual investors because of their smaller purchasing power and lack of access to real estate deal-makers.

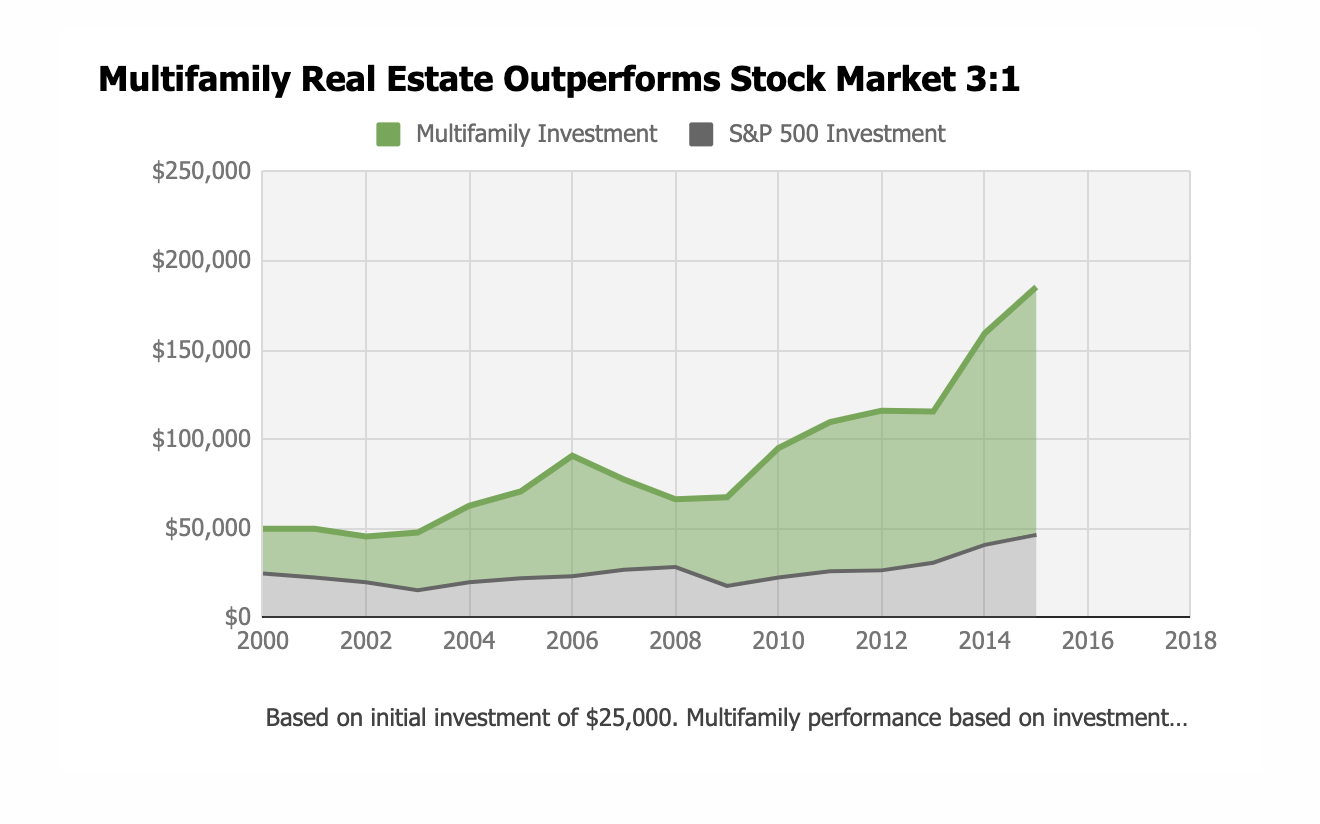

Various models of real estate crowdfunding have enabled investors of all levels, both unaccredited and accredited retail investors, an opportunity to grow their wealth and diversify stock or bond heavy investment portfolios. This new investment avenue is attractive for individual investors, as multifamily real estate investment has outperformed the stock market 3:1 since the beginning of the 21st century. Crowdfunding has proven to be a viable option for investment particularly as investors face the volatility of stocks and bonds during the inevitable downturn.

However, for individual investors, it’s important to evaluate a few essential factors when considering real estate crowdfunding. For example, the deal’s projected internal rate of return (IRR), projected equity multiple, and the sponsor’s track record.

Learn More about essential factors to consider when vetting a real estate crowdfunding investment.

While real estate crowdfunding is new, the same principles of sound investing apply. If the real estate crowdfunding platform is deemed trustworthy and the deal sponsor has a favorable track record, investors can then evaluate the deal’s business plan by thoroughly reviewing it and assessing the dynamics of the local market and property.

Institutional real estate investments are known as high quality assets — properties in major, secondary or sometimes tertiary markets with stable tenant bases. The PwC Real Estate Investor Survey clarifies the notable differences between institutional and non-institutional real estate:

- Institutional quality real estate usually garners more attention from larger investors. Non-institutional investments can be made by anyone.

- Institutional quality property faces less risk of obsolescence physical deterioration during the holding period following investment.

For example, the 607-unit Southern States Multifamily Portfolio offered to ArborCrowd investors in 2017 featured three properties, two in Huntsville AL and one in Robinsonville, MS. Both properties are located near key job markets in both the entertainment and technology industries.

View the complete case study — Realized Investment: Southern States Multifamily Portfolio

The Robinsonville property, Gardens of Canal Park, is located within the sixth largest casino and gaming market in the country and is only a 30-minute drive to Memphis, TN. The Huntsville properties are in close proximity to the University of Alabama in Huntsville, and the Marshall Space Flight Center, the largest NASA complex in the country. Additionally, Cummings Research Park, the second largest science and technology business park in the country, provides 25,000 jobs to the Huntsville area.

Combining properties from multiple markets reliant on different industries for employment provided diversification and helped reduce exposure to any singular disruption of one industry. Additionally, the sponsor saw an opportunity to acquire the properties at a steep discount due to historic underperformance following the previous owners’ mismanagement.

Following a well-executed capital improvement plan in excess of $1 million and the implementation of operational enhancements and renovations, the sponsor sold the Robinsonville property in November 2017, which resulted in ArborCrowd returning $1.33 million to investors. The Huntsville properties were sold in June 2018, resulting in another $1.3 million returned to investors and closing out the transaction in under 2 years.

The ArborCrowd Difference

While there are many real estate crowdfunding platforms, ArborCrowd is the first real estate crowdfunding platform launched by a real estate institution. As part of The Arbor Family of Companies, which includes Arbor Realty Trust (NYSE:ABR), a leading publicly traded commercial mortgage real estate investment trust, ArborCrowd is backed by more than 30 years of leadership experience. ArborCrowd reviews more than 500 deals a year from a proprietary network and only chooses the ones that survive a rigorous underwriting process.

Unfortunately, many real estate crowdfunding platforms utilizing different models invest in properties that are overpriced or fail to meet their stated criteria for investments in order to show progress to their backers (often venture capital firms) — at the expense of investors. Differing real estate crowdfunding models offer varying degrees of transparency regarding the property investors are buying into. Moreover, new real estate crowdfunding platforms with a primary focus on technology lack the industry expertise to evaluate the merits of the market, sponsor, and property. While the deal may be touted as “institutional real estate,” investors with dollars on the line in these properties may be more at risk.

ArborCrowd prefunds capital in a deal prior to launching the offering to investors. This ensures the deal closes and allows ArborCrowd to offer investors accurate and detailed information about the property. Additionally, ArborCrowd chooses to present one deal at a time, so there is no guessing what property investors will actually own.

When it comes to investing in institutional real estate, ArborCrowd’s decades of experience, commitment to transparency, and stringent underwriting benchmarks ensure that individual investors have access to quality deals that have the potential to generate strong profits.

Learn more about ArborCrowd’s unique model, and how it works.