In the multifamily real estate sector, there are various types of properties one can invest in, such as townhomes, garden-style apartments, and mid- and high-rise residential buildings to name a few. Another type that has been gaining popularity among tenants is single-family rental (SFR) communities. As homes have become less affordable to buy, millennials are seeking more spacious housing in the suburbs to start families, and the COVID-19 pandemic made remote working mainstream, allowing many to move away from urban centers.

More real estate institutions are recognizing that SFRs share common characteristics with traditional apartment complexes and are developing and operating communities of build-for-rent homes to capitalize on the strong opportunity in the market.

Why Investing in SFRs Is Not a Huge Leap From Apartments

On the surface, SFRs differ from apartment buildings in that each unit is fully detached, and features a backyard and a driveway as opposed to a common yard and central parking lot. But despite their distinct appearances, SFRs and apartment buildings share many commonalities from an investment approach.

Underwriting

Rigorous underwriting is at the center of the success of all multifamily real estate deals. Institutional investors aren’t only looking at SFRs as individual for-sale homes anymore, but as income producing properties, so underwriters use a similar approach to evaluate SFRs and apartments. They’ll look at the demand to live in the area compared to the supply of current and future units, and whether the deal makes financial sense based on the level of rents the units can achieve, and expected operating expenses.

During this phase, the sponsor will screen various deals and zero in on the ones with strong fundamentals that deserve a deeper dive. Regardless of the deal, whether it is a community of SFRs or an apartment building, the goal is to identify deals that will produce strong risk-adjusted returns based on the pro forma and the sponsor’s business plan. To aid in this, underwriters validate assumptions by evaluating market data, reviewing historical performance of existing assets, and learning competing properties and neighborhood amenities. They will typically also visit the properties to conduct site inspections, assess the market, and interview management staff.

For both kinds of building types, there could be deals offering high internal rate of returns and equity multiples, however, the returns will depend on the deal strategy, location and various other factors.

Leasing, advertising and stabilization

Another similarity in the investment approach would be the lease-up process of the properties. There isn’t much of a difference in advertising the properties to new tenants, and tours of units would be conducted in the same fashion as they would be for apartments. Additionally, as SFRs and apartments offer the same product – a rental unit – the lease terms would be similar short-term leases commonly found in the housing sector, unlike the long-term leases usually found in office and retail properties.

After the purchase or development of an SFR or apartment building, sponsors generally look to stabilize the asset, meaning they would lease up the property to an occupancy level that is in line with competing properties in the market. Achieving this stabilization is important because it shows the asset can generate meaningful revenues and reliable cash flows. This may allow for the property to qualify for longer financing with better terms, ultimately increasing returns for investors.

Rental side

Whether it’s SFRs or apartments, it essentially all boils down to being on the rental side of the market as opposed to the for-sale side, and the rental market is increasingly looking more attractive.

Currently, home prices are at all-time highs, according to the most recent data from the U.S. Census Bureau, and simultaneously the homeownership rate is dropping. Many people are choosing to rent, which may bode well for the multifamily industry as a whole. Because of COVID-19, people now desire more spacious living arrangements in less dense markets, one of the drivers behind SFR communities having their moment in the sun.

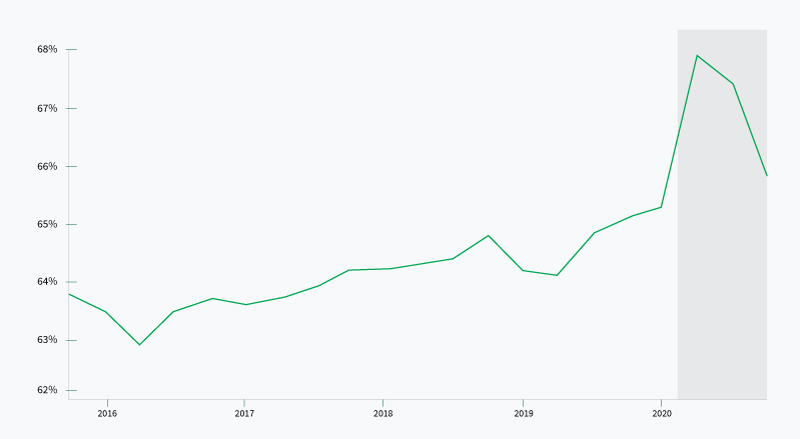

Homeownership Rate for The United States

The U.S. homeownership rate dropped from its recent high of 67.9% in Q2 2020 to 65.8% in Q4 2020. As prices have continued to rise for homes, there has been more interest to rent.

Source: U.S. Census Bureau

What Separates SFRs and Apartments

While SFRs and apartments are similar from a transactional perspective, there are differences that an investor should be aware of when considering an investment in either type.

Economies of scale

With garden-style, mid-rise and high-rise apartment buildings, each of which house multiple units within a structure, making a repair to a common amenity or item, such as the roof, is effectively making that repair for every unit within the building. The efficiency of common repairs in apartments create more economies of scale.

Meanwhile, SFRs comprise many individual units with individual roofs, so there could be increased capital expenses when hundreds of roofs have to be replaced at the same time. Another example is yardwork on an SFR community. Each unit will have a separate lawn that needs to be maintained, while there could be just one common yard for an apartment building.

Location

Naturally, building SFR communities requires a lot of land, so typically these properties are found in suburban areas or less developed markets where the cost of land is generally cheaper than downtowns or more established markets. It’s not typical that these properties will be developed within the urban core of a major city, as land prices would be higher on a per unit basis and it will be more feasible to develop apartment buildings, which can produce more units on smaller lots.

Moreover, SFRs are being developed in the Sun Belt region, a term for the southern section of the United States from California to North Carolina. This is because businesses and people have been attracted to states in the Sun Belt for lower costs of living and milder climates. Additionally, states in the Sun Belt generally have more available land to develop new housing in places where people desire to live.

Opportunity

Apartment buildings are expensive for the average person and require a lot of operational management to be well maintained, leaving institutional companies to dominate that segment of multifamily real estate. This means the competition for buyers and sellers will typically be more rigid.

However, SFRs are dominated by individual owners. Nearly 90% of single-family rentals are owned by mom-and-pop investors, according to GlobeSt. With less institutional competition, there’s more opportunity for professional institutions to find price dislocations. This is a trend that may not last for long as more institutions are taking notice of the opportunity SFRs present.

Conclusion

Between SFR communities and apartment buildings, the question should not be which one is better to invest in. Both types of investments can reap substantial returns. What’s important is to analyze and understand each individual deal and make sure the business plan aligns with the fundamentals and market trends.