What is Mezzanine Debt in the Real Estate Capital Stack?

Mezzanine debt is a type of subordinated financing used to increase leverage – and levered returns – in a commercial real estate transaction. Mezzanine debt fits between common equity and senior debt in the capital stack, because it has priority of repayment over equity, but is subordinate to senior debt.

Similar to senior debt, mezzanine loans have fixed or floating interest rates and set maturity dates. Some other features of mezzanine debt include:

- Higher interest rates than senior debt.

- Secured by a pledge of interest in the property ownership entity.

- Less risk than common equity due to collateral.

Mezzanine loans have many distinct features and applications to be aware of, and in this article, we’ll explain the collateral for mezzanine debt, how this type of financing is used in real estate transactions, and the differences between mezzanine debt and common equity for investors.

How is Mezzanine Debt Used in Real Estate Investments?

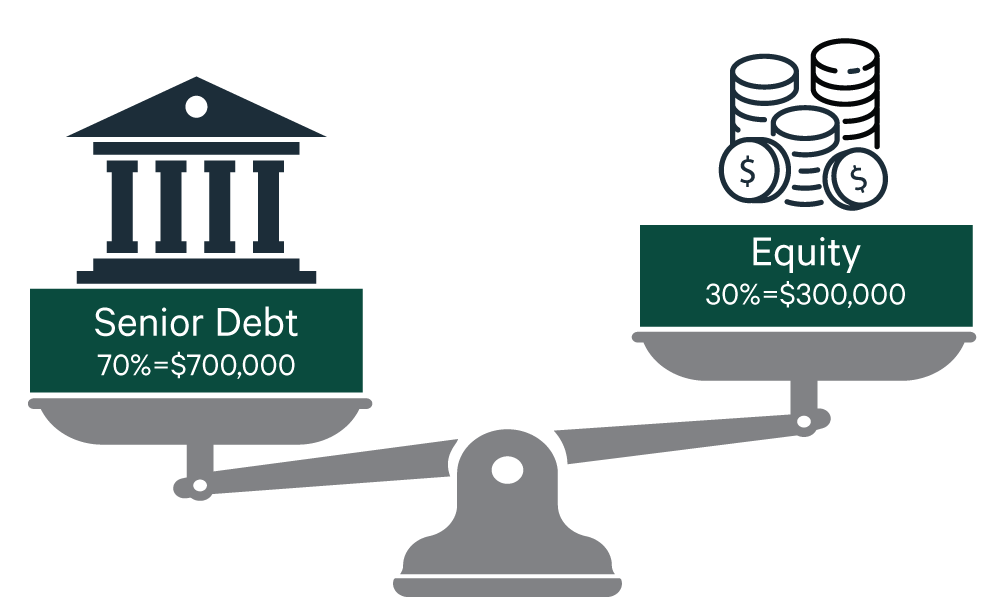

Let’s say a real estate sponsor wants to buy a building for $1 million.

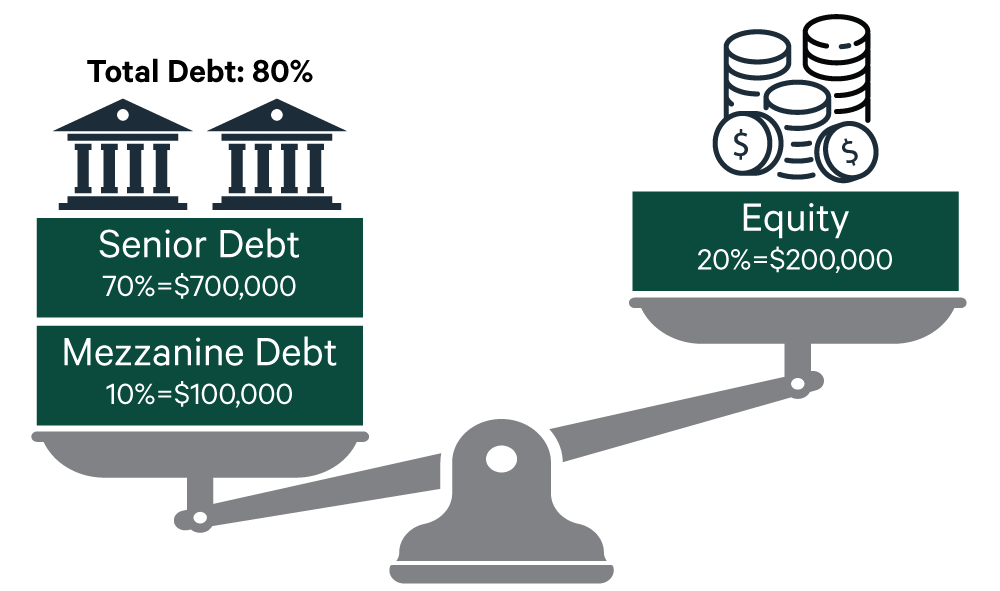

A senior lender will only loan the sponsor 70% of the purchase price, or $700,000 and will charge the sponsor a 4% interest rate, or $28,000 per year. The sponsor, however, does not want to tie up $300,000 of its equity, so it finds a mezzanine lender willing to lend an additional $100,000. The mezzanine lender will charge the sponsor an 8% interest rate, or $8,000 per year. With $800,000 of combined financing the sponsor will only have to put up $200,000 of equity to buy the building. The property generates $50,000 after all expenses are paid each year.

The property is sold for $1.1 million three years after the sponsor purchases it.

Returns with 70% Leverage

IRR: 17%

Equity Multiple: 1.55x

Profit: $166,000

Returns with 80% Leverage

IRR: 21%

Equity Multiple: 1.71x

Profit: $142,000

The illustration above demonstrates how the additional leverage from a mezzanine loan will increase the sponsor’s returns while also minimizing the sponsor’s required equity to buy the building.

Sponsors typically borrow senior debt to finance up to 70% of the total proceeds needed to fund a real estate transaction, depending on what a lender is willing to approve. If a sponsor chooses not to fund the remaining 30% with equity, they may obtain mezzanine debt for a portion of that remaining capital needed.

For example, they could finance an additional 10% of the project with a mezzanine loan, which would allow them to fund the deal only using 20% of equity. This could significantly reduce their equity exposure in one particular transaction as well as increase their levered returns.

Other reasons why sponsors obtain mezzanine debt include:

- To free up capital for other investments.

- Create liquidity to return capital to investors or make property improvements.

While adding more leverage to a capital stack with mezzanine debt may increase the risk for investors, the level of risk could vary based on the investment strategy.

Mezzanine debt obtained behind a permanent senior loan collateralized by a stabilized core asset can be viewed as less risky than mezzanine debt behind a senior construction or bridge loan, which may be secured by a value-add project or ground-up development. This is because the business plan for a stabilized asset is to maintain occupancy and achieve market rents, whereas the focus of the business plan for a value-add or opportunistic deal is first to complete the project and then lease it up, which is inherently riskier.

Similarly, for mezzanine debt holders, their investment in the mezzanine debt may also be viewed as less risky depending on the investment strategy of the underlying real estate investment. However, in all cases, the mezzanine debt holder’s investment is collateralized, affording the mezzanine debt holder recourse if the mezzanine borrower were to default.

What is the Collateral for Mezzanine Debt?

Mezzanine debt is not directly collateralized by the underlying real estate like senior debt. Instead, when a borrower obtains mezzanine debt, that mezzanine loan is secured by a pledge of the mezzanine borrower’s ownership interest in the property owner, which is the entity that owns the underlying real estate.

If a borrower defaults on a senior loan, the senior debt holders have the right to foreclose on the real estate. However, if the borrower defaults on the mezzanine loan, then the mezzanine debt holders can foreclose on the pledge and take over ownership of the entity that owns the property.

While this gives mezzanine debt holders recourse in the event of a default on the mezzanine loan, they will still be subject to the senior debt and must continue to make senior loan debt service payments.

Mezzanine debt is sometimes compared to preferred equity, which is a class of ownership senior to common equity that is often referred to as a hybrid between debt and equity. Like mezzanine debt holders, preferred equity holders also receive interest payments on their invested capital for a fixed term. But unlike mezzanine debt, preferred equity holders may not foreclose on the pledge of ownership interest in the entity that owns the property as preferred equity represents ownership shares and is not structured as a loan. Instead, preferred equity holders may have the right to take away control of the entity that owns the real estate from the common equity investors upon certain defaults.

However, mezzanine debt holders typically have less risk than common and preferred equity investors, since debt has priority over equity.

Investments in Mezzanine Debt vs Common Equity

Common equity typically has the highest potential upside in a real estate transaction compared to other layers of the capital stack. If a deal is successful, the common equity holders may receive large returns from the appreciation in value.

In exchange for this upside, common equity typically carries higher risk than other components of the real estate capital stack. Common equity investors could potentially lose all of their invested capital if the deal is unsuccessful since they are in the first-loss position.

Investors in a mezzanine loan may have less risk than a common equity investor in the same transaction, because in the event of a default on the mezzanine loan, mezzanine lenders can take over ownership of the property owner to cure the default. Also, mezzanine debt holders typically earn interest and have priority of repayment ahead of common equity investors.

While many investors choose to make both debt and equity investments, capitalization rates for equity investors are currently being compressed due to a confluence of factors, including increased demand for multifamily properties, low interest rates, and rising construction costs. Mezzanine debt could provide an opportunity for investors to obtain higher returns than senior debt with a more protected position than common equity.