What is Net Operating Income (NOI)?

There are many factors that determine the success of a real estate investment. One of those is maximizing net operating income (NOI) so a property can produce optimal returns for investors.

NOI is the annualized income after operating expenses from a property. NOI is an essential figure to calculate in order for real estate operators to assess the potential profitability of a property when underwriting an investment.

Net operating income can be used to find other important measures about a property as well, such as the cash on cash return, capitalization rate (cap rate) or debt service coverage ratio (DSCR). In this article, we will explain how to calculate net operating income, how it is used, and why institutional investors can better maximize NOI?

What is NOI in Real Estate?

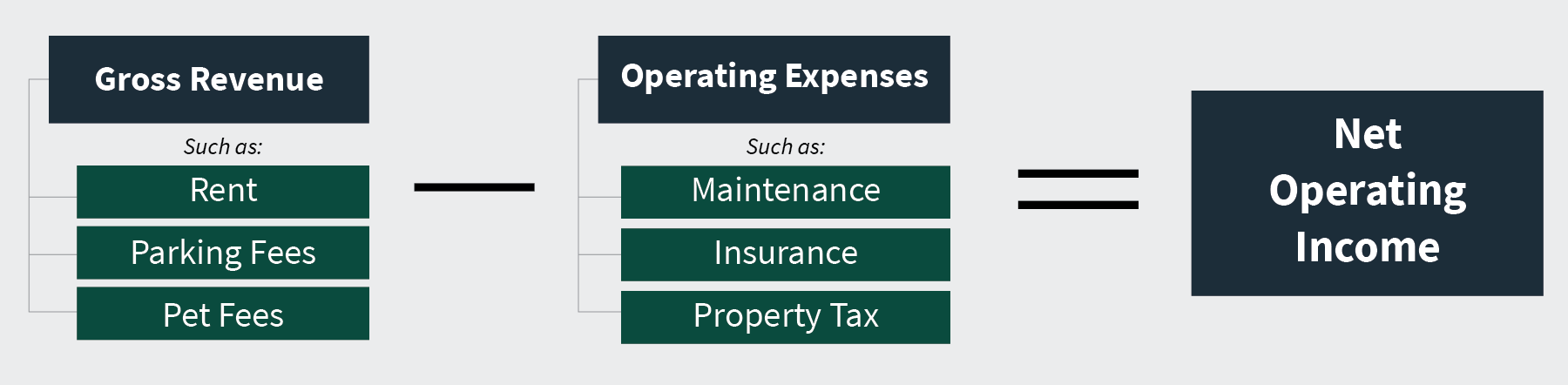

NOI is an extremely important metric to calculate when acquiring or assessing a property, as it denotes how much money it can produce, and therefore the profitability of the real estate investment. The formula to find NOI is:

To calculate NOI, it is first necessary to find a property’s gross revenue by combining all of the income received from the property over the course of a year.

Income could be derived from:

- Rents

- Late fees

- Fitness center fees

- Laundry fees

- Pet fees

- Parking fees

- Application fees

After determining gross revenue, real estate underwriters would then find the property’s “effective income” by deducting vacancy, credit loss and concessions, which are useful incentives to entice prospective and existing renters to sign leases or renewals. Then they would combine the operating expenses of the property over the year and deduct that from gross revenue as well.

Operating expenses include:

- Maintenance

- Repairs

- Utilities

- Leasing and marketing fees

- Legal fees

- Administrative fees

- Management fees

- Insurance

- Property taxes

Net operating income does not take debt service into account as an expense, as it is not a core operating expense to maintain the property.

Other items not included as expenses in NOI calculations are:

- Capital expenditures

- Income taxes

- Depreciation

- Tenant improvements

How NOI Is Used to Evaluate Real Estate Investments

NOI indicates how much money a property can return. This makes it a useful figure for determining everything from the value of a property to how a property’s income compares to its debt.

NOI is one of the main components of the capitalization rate (cap rate), which is the annualized rate a property is expected to return in the first year of an unleveraged acquisition. Cap rates are widely used to evaluate prices to buy or sell properties. Typically, buyers want higher cap rates and sellers want lower cap rates. The formula to calculate a property’s cap rate is:

NOI / Property Price = Cap Rate

By calculating cap rates from recent sales in a given market and including certain factors for a specific property, it is possible to find a suitable cap rate for that property. It is also possible to quickly estimate the value of a property by adjusting the cap rate formula to solve for the price.

In addition, NOI can be used to find the cash on cash return of a property, which is the ratio between annual operational net cash flow and the total equity invested in a deal. The cash on cash return uses this simple formula:

Cash Flow / Invested Cash = Cash on Cash Return

Cash on cash return is used by sponsors to understand the current and future income profitability of an investment when acquiring a property. To find a property’s cash flow, deduct debt service from NOI.

Another way NOI can be useful is to estimate a property’s debt service coverage ratio (DSCR). This metric determines how much income is available to cover debt obligations. It is used by lenders to examine whether or not a borrower can pay down a loan. The formula for DSCR is:

NOI / Debt Service = DSCR

Lenders prefer higher DSCRs, because it indicates that the property is producing sufficient income to pay down the mortgage. During a recession, lenders tend to tighten borrowing terms and may require higher DSCRs for new loans, but in a healthy economy they may approve loans with lower DSCRs.

Institutions Maximize NOI to Increase Real Estate Profitability

One of the benefits of investing with a real estate institution, such as ArborCrowd, as opposed to direct ownership of real estate is that institutions employ experienced real estate professionals who know how to maximize NOI.

Typically, non-institutional real estate owners exhibit a more passive management style, and they are willing to sacrifice achieving market rents to maintain tenants for longer terms. Institutions can more efficiently deal with tenant turnover, and are focused on achieving market rates to maximize NOI. For example, professional managers could utilize better leasing and marketing processes to quickly fill vacancies.

Additionally, institutions could make managerial or operational changes to enhance efficiency at a property and lower operating expenses, which also could increase NOI. Moreover, institutions are able to increase gross revenue from alternative sources besides rents.

Alternative sources of revenue include:

- Parking lots

- Pet services

- Storage space

- Daycares

- Fitness centers

Conclusion

Net operating income is an important figure to determine the profitability of a real estate investment. In existing properties, strong NOI can denote that the property is stabilized and has the potential to produce cash flow for investors. Institutions can be more adept at maximizing NOI than retail investors, because they employ experienced professionals who are able to handle tenant turnover, make property operations more efficient, and increase gross revenue from alternative sources. ArborCrowd’s underwriting team relies on more than just NOI when analyzing a potential opportunity. There are numerous factors, assumptions, and metrics calculated during ArborCrowd’s rigorous underwriting process to find deals with the highest potential for success.