Single-family home builders are pressing the brakes on new products as demand to purchase homes has declined amid rising mortgage rates and inflation.

The rate of single-family housing starts was 916,000 units in the one-year period ending in July 2022, which represented a decrease of 18.5% from the same period ending in July 2021, according to the U.S. Census Bureau. This was the lowest level for single-family housing starts since June 2020, just a few months after the COVID-19 pandemic began in the U.S.

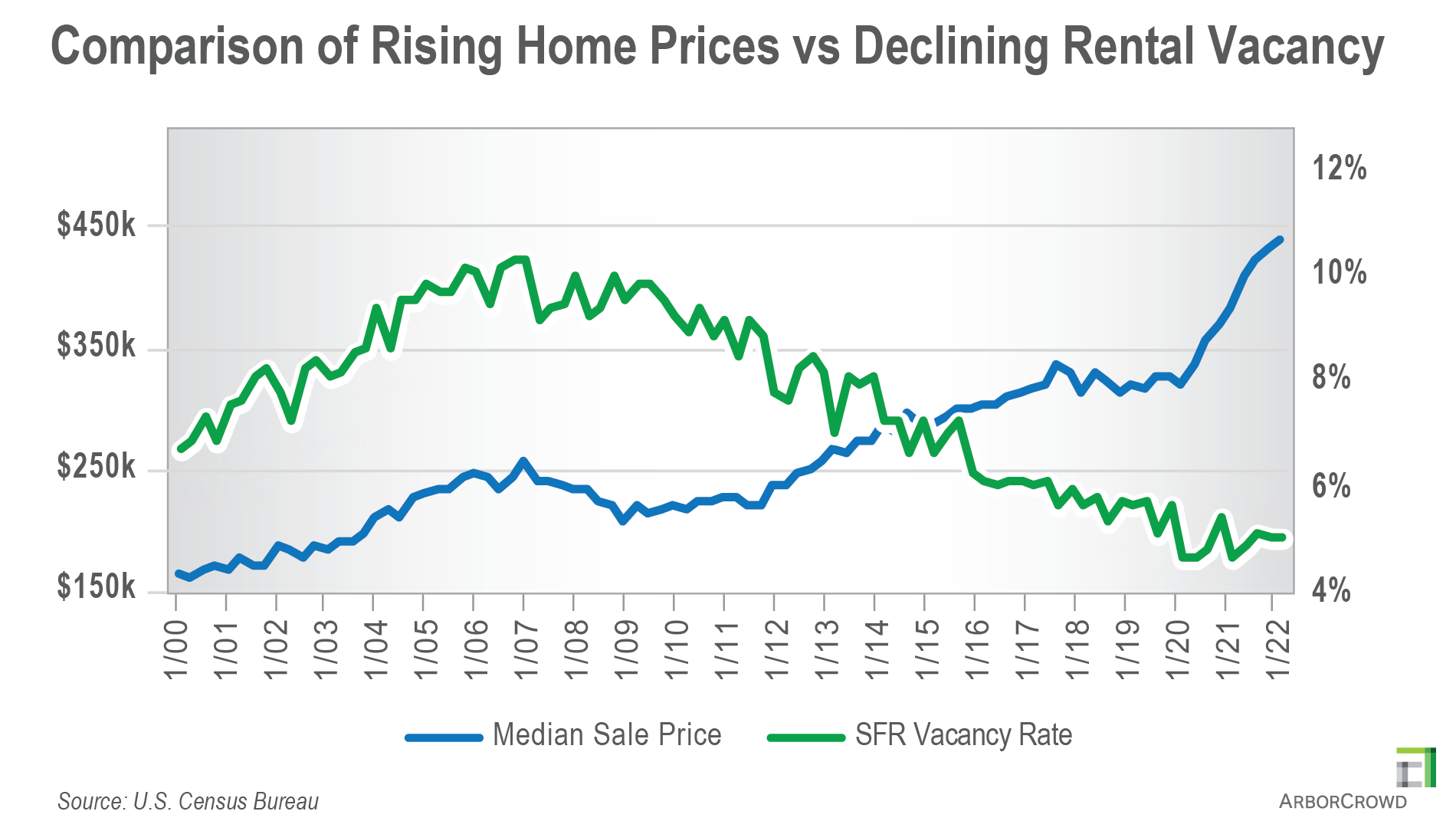

The shift in demand for for-sale homes may be attributed to the increased expenses of homeownership: median home prices are near record highs as demand for homes accelerated during the pandemic due to a need for more privacy and space. Additionally, mortgage rates are rising dramatically. Average 30-year mortgage rates were consistently below 3% in August 2021, but are currently above 5%. Mortgage rates are rising because of the Federal Reserve’s aggressive interest rate hikes to counter high inflation, which was 8.5% in July.

Due to the high prices and rising mortgage rates, housing affordability fell to its lowest level since the Great Recession, according to the National Association of Home Builders (NAHB). Furthermore, low housing inventory — an ongoing issue that predates the pandemic — is also making it challenging for families to find and close on homes.

Now home sales are stalling and prices have begun to fall from record highs as the market adjusts. Home builder sentiment has fallen for eight consecutive months and is at its lowest point since May 2020.

Single-Family Rentals (SFR) and Build-to-Rent (BTR) Properties Are Benefitting from the Slowdown

The beneficiary of the decreasing demand of for-sale housing are multifamily rental properties. While single-family housing starts fell in the year ending in July, during the same period, multifamily housing starts (for residential buildings with at least 5 or more units) increased 17.4% to 514,000 units, Census Bureau data indicated.

The single-family rental (SFR) and build-to-rent (BTR) segment of the multifamily sector in particular stands to benefit from the slowdown in housing starts and falling demand to purchase homes. People still want to live in single-family residences even if they can’t afford to own them, because they offer more space for larger families, are more conducive to remote working, are typically in neighborhoods with a higher quality of life, and have private garages and yards.

While home prices have begun to fall, they still haven’t reduced far enough to compel homebuyers to return to the market at previous levels. Additionally, the threat that mortgage rates could continue to rise as inflation persists may also keep potential buyers on the sidelines. Besides the cost savings compared to for-sale homes, SFR/BTR are also attractive because it offers greater flexibility to relocate, professional management and maintenance, and more amenities than owner-occupied single-family homes.

Rents for SFR units are continuing to grow as demand remains high. Average single-family rental asking rents increased to a record $2,092 per month in July 2022, which represented 11.2% growth from the prior year, according to Yardi Matrix’s latest national multifamily rent report. Additionally, SFR vacancy rates have been around 5% over the past year, which is the lowest it has been since the mid-1990s, according to Census Bureau data.

Noticing the shift in demand to single-family rentals, developers began constructing 69,000 SFR/BTR units over the year ending in Q2 2022, which was an increase of more than 60% over 43,000 units in Q2 2021, according to an NAHB analysis of Census Bureau data.

The U.S. still faces a country-wide housing shortage, and while for-sale home sales are slowing due to rising mortgage rates, inflation, and low inventory, SFR/BTR homes has been filling the void for a growing population of renters. As for-sale single-family home starts dwindle, labor and supply costs could come down for SFR/BTR developers further boosting the growth of the sector.