Once considered an option of last resort, SPACs – short for “special purpose acquisition companies” – have become an increasingly prominent way for companies, especially younger ones, to enter the public markets. As an alternative to the more traditional initial public offering (IPO) process, SPACs are now popular vehicles that are being used more widely than ever before. In fact, notable celebrities, such as Alex Rodriguez, Shaquille O’Neal, Stephen Curry, Jay-Z and Serena Williams, in addition to many real estate heavyweights, are throwing their hats in the ring to get involved with SPACs – some of whom have already taken companies public using a SPAC.

So why the seemingly frenzied attention on SPACs, particularly in the last year or so? First, let’s define what a SPAC actually is.

What Is a SPAC?

SPACs are sometimes referred to as a “blank-check company.” Simply put, they are cash shell companies that are formed to bring a private business public. There are essentially two parties involved in a SPAC’s lifecycle. The first is the sponsor, or the entity that forms the SPAC via an IPO. The second party is the target company, which is typically a promising young company that will be taken public through the merger or acquisition with the SPAC. Sponsors are tasked with searching for and structuring the transaction to merge with or acquire the target companies.

For the young companies, the capital that SPACs raise allows for faster growth, effectively enabling them to obtain late-stage growth capital earlier in their lifecycles. Some examples of high-profile companies that have gone public via the SPAC method include DraftKings, Virgin Galactic and Utz Brands.

SPAC Lifecycle

SPACs can be an attractive alternative to the IPO process because they are generally faster, cheaper and have less regulatory oversight. The lack of regulatory requirements allows for more abundant opportunities to market the company during the “de-SPAC” period, which is the period of time after the business merger is announced but before it’s actually executed. In comparison, a company filing for an IPO cannot ramp up its marketing efforts after filing their intent to go public with the Securities and Exchange Commission (SEC), even on a confidential basis.

How Has the Commercial Real Estate Industry Been Involved with SPACs?

While traditional real estate companies don’t necessarily fit the profile for SPACs, more are seeking to go public via this avenue, especially property technology companies, such as Latch and Opendoor. Experts predict that real estate SPACs moving forward are more likely to focus on sectors with strong appreciation potential, such as data centers, life science labs and specialized industrial properties, rather than more traditional real estate companies focused on steady-yielding assets.

Who Can Invest in a SPAC and What Are Some Potential Risks?

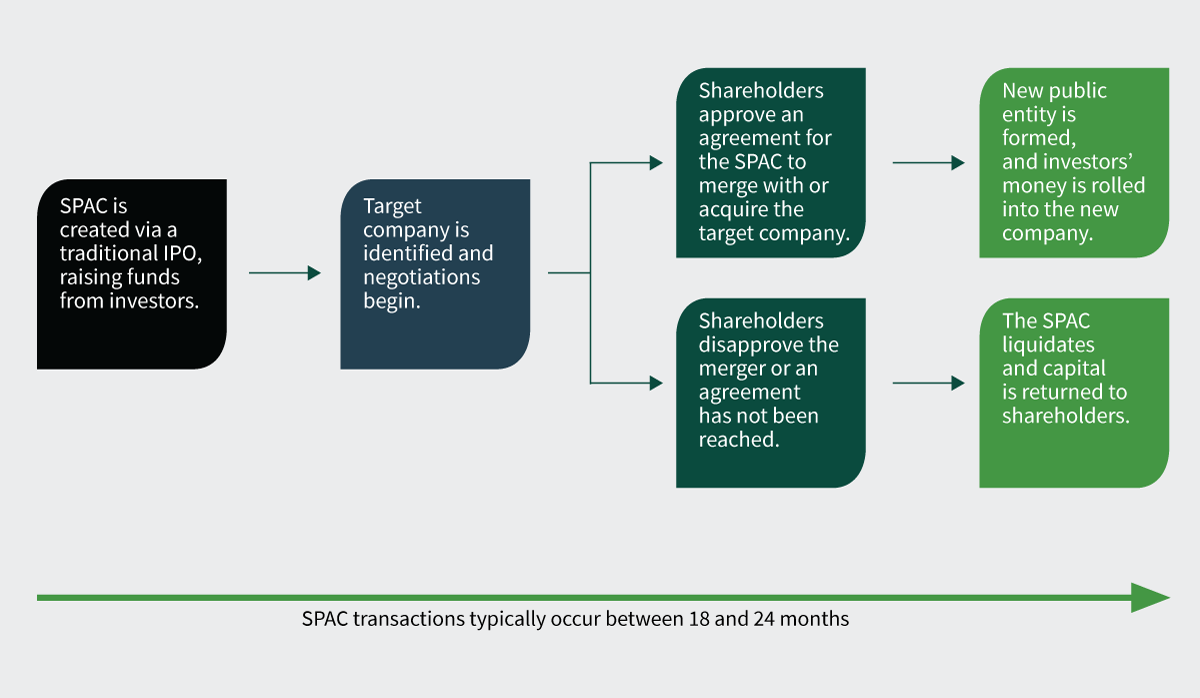

Any individual can invest into a SPAC since they’re publicly traded. Once the SPAC acquires its target company, investors’ capital is automatically rolled into shares of the newly formed public entity. At this point the SPAC can begin trading under a new ticker symbol more in tune with the target company. This provides retail investors with unique access to high-growth companies that they wouldn’t otherwise have the opportunity to invest in at such an early stage. The process of identifying a target company can be lengthy for SPACs, with investors sometimes waiting up to two years. If the transaction is not completed within the allocated time frame, the SPAC is liquidated and investors get their money back with interest.

One risk of investing in a SPAC is the lack of a price discovery stage for the target company. In a traditional IPO, it is common to have one or more investment banks build a book to establish the expected pricing for the IPO based on the underlying company’s financials. Banks look to price shares with knowledgeable institutional investors before the IPO and receive bids for the price per share and quantity of shares that institutions would be willing to purchase. This helps determine what price per share a company will debut at on the public market. Since the acquisition of a target company by a SPAC occurs after its IPO, the shares of the SPAC are already in the open market, so no book is built based on the target company’s financials. Subsequently, if the open market determines that the price paid for a target company was too high, SPAC stock prices could fall.

Since investors will not have visibility into how a target company will perform post-SPAC transaction, and target companies are generally startups (and in many cases pre-revenue), the decision to invest is usually contingent on the sponsor’s reputation. The lack of public financial information and looser restrictions on disclosures for target companies make an investor’s vote of confidence in the sponsor that much more critical. SPACs’ recent prolificacy is also inviting a higher degree of scrutiny from the SEC, which recently released a statement critiquing how SPACs value warrants, which gives investors the right to buy shares of a company at a certain price and by a specific date in the future. SPACs use warrants to raise money from institutional investors.

According to The Wall Street Journal, the SEC is worried about the frenzy around SPACs because in many instances, investors have been burned by over-hyped SPAC transactions. Dozens of SPACs are now trading below the $10 price at which they sold shares, which some argue is a natural correction to their previously inflated valuations.

In the case of Nikola Motor Company, which designs and manufactures electric vehicles, short seller Hindenburg Research published a report alleging fraud and false statements made by the company’s founder just a few months after going public. This resulted in General Motors backing out of a previously announced deal to acquire an equity stake in the company, sending the stock price tumbling. This scenario shows the inherent risk in any public investment, but especially in a SPAC target company that had not been subject to the same amount of due diligence as an entity that had gone public through an IPO would have.

Do Your Own Research

Like any good investment, retail investors should always proceed with caution and do extensive amounts of homework before deciding to invest in a SPAC. While many have been great successes, there have also been some alarming failures. As the markets continue to recover from the global pandemic and other external factors, arming yourself with as much knowledge as possible to navigate these uncharted waters is always the most beneficial tool at your disposal as an investor.