The Texas multifamily real estate market has performed exceptionally well over the 12-month period ending in Q2 2022, as four metro areas in the Lone Star State (the most of any state) earned a spot in the top 20 markets for multifamily investments, according to CBRE.

Dallas-Fort Worth led the country in multifamily investment volume with $27.8 billion, Houston earned sixth place with $17.2 billion, Austin ranked 12th with $9.2 billion, and San Antonio finished 18th with $6.5 billion. These Texas markets were also among the top 20 areas for annual net absorption of rental units, CBRE reported.

The strong market results are unsurprising given the impressive annual population growth for the state of more than 310,000 net new residents between 2020 and 2021, which was the largest gain by any state over that period, according to the U.S. Census Bureau.

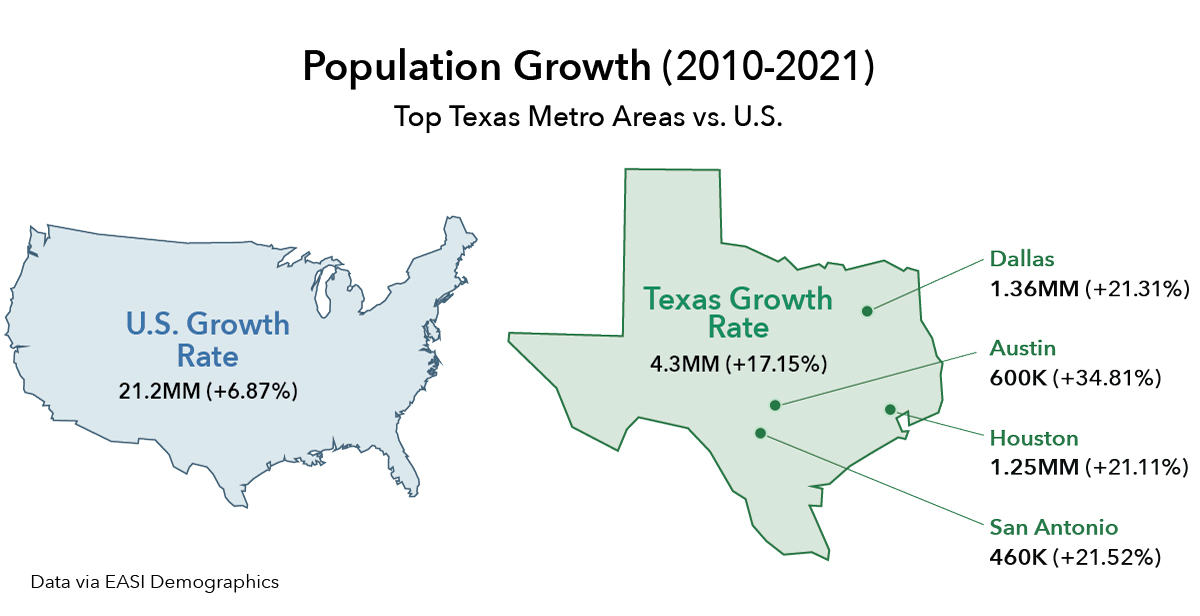

This growth is an extension of a decade-long domestic migration trend. Between 2010 and 2021, the population of Texas increased by 4.3 million people to a total of nearly 29.5 million people — the largest net gain of residents for any U.S. state in that time period, according to data from EASI Demographics.

This unparalleled population growth has boosted housing demand, resulting in a boon for the multifamily sector. There are various reasons why people are moving to the state in droves, but some of the key factors include affordability, strong employment opportunities, and a high quality of life.

Affordability of Texas Real Estate Markets

Notably, more than half of all new Texas residents (55%) are migrating from other states. Californians in particular are making Texas their new homes because of its affordability. For example, the cost of living in San Antonio is 8% lower than the national average. Meanwhile, the cost of living in San Francisco is 94% higher than the national average.

Texas is just one of nine states in the country that doesn’t charge personal income tax and it has a lower overall tax burden than 31 other states. Low taxes are one contributing factor to the low the cost of living in Texas’s metro areas.

Another contributing factor to the low cost of living is the price of housing. The trend of individuals and families leaving expensive major coastal cities, such as San Francisco or New York City, in search of more affordable housing began prior to the pandemic. However, the virus’s spread accelerated the trend by changing the perception of living in dense primary cities, and increased remote working allowed people to untether their homes from a commutable distance to their jobs.

Housing is the largest expense for most families, and Texas markets offer more affordable housing options with many of the same advantages of the coastal markets. In Austin, the median price of a 2-bedroom unit is $1,860 per month and in Dallas it is $1,490 as of April 2022, according to Apartment List. This compares to New York City’s median 2-bedroom unit price of $2,250 or San Francisco’s $2,680 per month.

Besides pricing, Texas markets allow for more single-family rentals (SFR) and build-to-rent (BTR) communities than dense coastal markets, which gives tenants who can’t afford to purchase a home the opportunity to experience home-living. SFR and BTR units have exploded in demand because aging millennials struggling with student debt are forming families and need more spacious housing, which dense gateway cities can’t provide.

Strong Employment Opportunities Abound in Texas

In addition to being more affordable, Texas is a business-friendly state that offers ample employment opportunities.

Texas hosts 53 Fortune 500 companies (the most in the nation) and 22 are located within the Dallas-Fort Worth metro area. The state has been a top target for domestic relocations of major companies, including: Tesla, Oracle, CBRE, Charles Schwab, and Hewlett Packard within just the past few years. Most new residents moving to Texas have been within ages 25-44, have bachelor’s degrees, and work in sectors such as business, computer science, engineering, and health care.

The top Texas metro areas have a lower cost of doing business than the average U.S. metro areas, which attracts businesses. Part of the reason why is because Texas does not charge income taxes on corporations. San Antonio’s cost of doing business, for instance, is 10.3% lower than the U.S. average, according to the Dallas Regional Economic Development Guide 2022. This is much lower than markets like New York and San Francisco, which are 53.4% and 88.1% higher than the U.S. average, respectively.

With strong population growth and a low cost of doing business, the workforces of the top Texas metro areas have grown exponentially faster than the average U.S. rate of 5.5% over the past decade ending in July, according to data from the U.S. Bureau of Labor Statistics. Austin’s workforce grew nearly 38%, Dallas-Fort Worth’s increased approximately 25%, San Antonio’s rose nearly 17%, and Houston’s expanded approximately 13% over the past decade.

High Quality of Life

Many Texas markets have downtowns filled with nightlife, historical places, and world-class recreational and cultural experiences (such as Austin’s well-known South by Southwest). They also have vibrant suburbs with great school districts, and a variety of parks, lakes, and other outdoor amenities.

- Austin was ranked 13th in U.S. News & World Report’s Best Places to Live 2022-2023 out of 150 metro areas — the highest ranking for any Texas market.

- San Antonio has a thriving leisure and hospitality sector, a diverse culture, and the city features a thriving downtown and various well-known attractions, such as the San Antonio River Walk and the historic Alamo, which is why it is currently the top destination to visit in Texas, according to U.S. News & World Report.

- Dallas-Fort Worth has one of the largest municipal park systems in the country and one of the largest entertainment hubs as well. The Dallas metro area ranked first in the nation for job growth from 2019 to 2021 (185,600 jobs created), according to the Dallas Regional Economic Development Guide 2022 based on data from the U.S. Bureau of Labor Statistics.

- Houston earned the top spot in WalletHub’s rankings of the most culturally diverse cities in America in 2021, and the city is currently sitting in 10th place for U.S. News & World Report’s best “foodie cities” in the U.S.

Texas is experiencing unparalleled domestic migration due to its affordability compared with dense coastal markets, strong employment opportunities and high quality of life. The top Texas metro areas — Dallas-Fort Worth, San Antonio, Austin, and Houston — each boast attractive features that have lured residents and promoted multifamily real estate investments.

If current trends of record home prices and a domestic migration to the Sun Belt persist, the strong demand to live in Texas could be sustained well into the future and multifamily real estate may continue its growth in the Lone Star State.