ArborCrowd allows individuals to invest in commercial real estate opportunities that were previously only available to institutional investors. We are now accepting new investors for our latest multifamily investment opportunity.

You are invited to join our latest dealWhite Rock Lake Apartments

Strong Market Fundamentals

The Dallas-Fort Worth-Arlington Metropolitan Statistical Area (“Dallas MSA”) has grown approximately 18.48% from 2010 to 2019, tripling the national growth rate of 5.89% during the same period.1 Furthermore, it is poised to become the third largest MSA in the country (behind only New York and Los Angeles) by 2045 with a projected population of 11.2 million, an increase of almost 50% from its current population of 7.5 million people.2

Over 825,900 people joined the Dallas MSA workforce from the end of the Great Recession to September 2020 — an increase of 25.7%.3 Additionally, the Dallas metro area led the country in job creation in 2019 with 127,000 net new jobs.2

Texas has attractive state grants to lure companies to relocate to cities in the state, and is only one of six states in the country that doesn’t charge corporate income taxes. The Dallas MSA is home to three Fortune 10 companies, 24 Fortune 500 companies and 44 Fortune 1000 companies.4 Since 2010, more than 140 companies have relocated their headquarters to the Dallas MSA.2

- U.S. Census Bureau

- Dallas Regional Economic Development Guide 2020

- U.S. Bureau of Labor Statistics

- Fortune.com

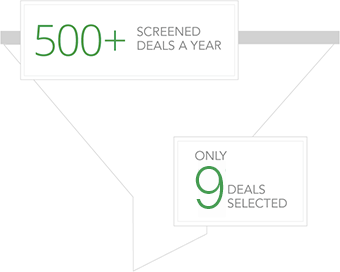

Responsible Real Estate Crowdfunding

We are the first Real Estate Institution to launch a Crowdfunding Platform, opening up our exclusive network to a new class of investors. Our leadership consists of seasoned real estate professionals who have survived various market cycles. We apply rigorous and institutional underwriting standards to each deal, and our experienced asset managers oversee their performance on behalf of investors throughout a deal’s lifecycle.

The ArborCrowd Advantage

As part of The Arbor Family of Companies, which includes publicly traded REIT Arbor Realty Trust and real estate private equity firm Arbor Management Acquisition Company, we have access to institutional quality opportunities from experienced sponsors.

Sioux Falls

This case study explains the successful exit amidst the COVID-19 crisis from a value-add, multifamily portfolio investment that featured an extensive renovation plan and the implementation of institutional management.

Quarry Station

This is the case study of a value-add, multifamily property that included a significant renovation strategy and rebranding effort, and was successfully realized despite micro and macro-economic challenges during the hold period.

Southern States Multifamily Portfolio

This case study examines a value-add, multifamily portfolio that included a well-executed capital improvement plan, which boosted occupancy rates and led to a successful realization.