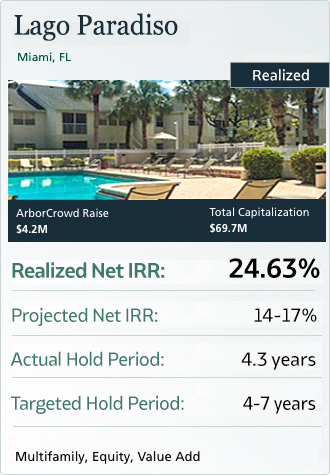

ArborCrowd announced that its Lago Paradiso multifamily real estate investment in Miami sold in the third quarter of 2021, completing the deal lifecycle of the property.

ArborCrowd announced that its Lago Paradiso multifamily real estate investment in Miami sold in the third quarter of 2021, completing the deal lifecycle of the property.

The $98.9 million sale of the investment generated a 24.63% net internal rate of return (IRR) for investors — substantially exceeding the initial projected net IRR of 14% to 17%. Lago Paradiso was realized in a little over four years, in line with the initial projected hold period range of four to seven years.

Lago Paradiso is the fourth ArborCrowd deal to be realized above the projected net IRR, following the Sioux Falls Multifamily Portfolio in 2020, Quarry Station Apartments in 2019, and the Southern States Multifamily Portfolio in 2018.

Read the full case study of Lago Paradiso to learn more about the transaction’s strong returns.

“This outstanding result is the product of a well-executed business plan by a seasoned institutional-quality sponsor, in a market that has experienced significant growth since the property’s acquisition,” said Adam Kaufman, Co-Founder and COO of ArborCrowd.

Kaufman added, “This is the outcome we strive for each time we bring an investment to the crowd, and we’re thrilled to continue outperforming on expectations as our deals complete their investment cycles. Our access to quality deals, focus on rigorous underwriting, and one-deal-at-a-time approach is what sets us apart. We will continue to invest the necessary time and resources and remain highly selective in the deals we present on our platform, to ensure that every one of our transactions is positioned to succeed.”

The 424-unit Lago Paradiso was acquired by the sponsor in May 2017 in an off-market transaction. The business plan encompassed the implementation of a nearly $4 million renovation of the property and individual units to capture rental premiums.

Property amenity enhancements included upgrading and expanding the fitness center, clubhouse improvements, new pool furniture, and a new dog park. Unit upgrades included granite countertops, wood-style plank flooring, new kitchen cabinets, bathroom vanities, and upgraded lighting. Additionally, the sponsor implemented institutional quality management and operations at the property.

As a result of the sponsor’s efforts to improve the property, the average monthly unit rent increased 25% during the hold period.