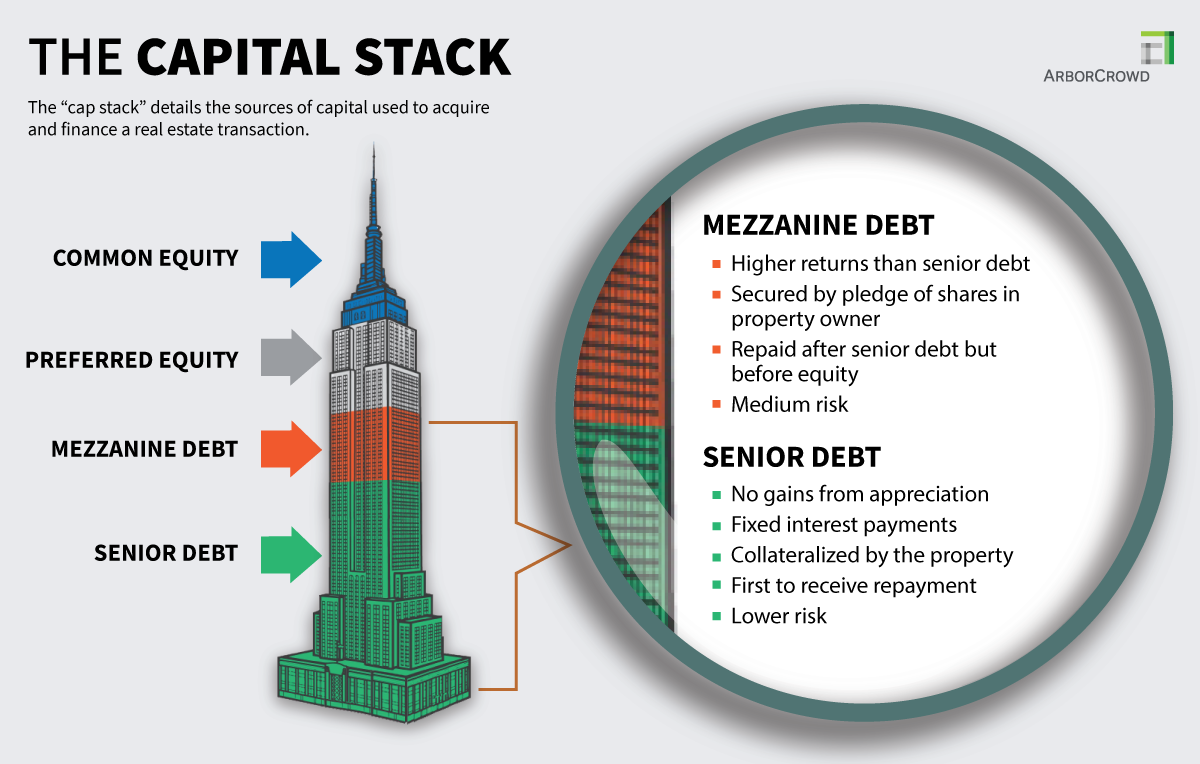

Commercial Real Estate Debt: What is it?

Debt is a loan or any borrowed capital used to fund a commercial real estate investment. Commercial real estate investments are typically made up of a combination of debt and equity, which comprise the real estate capital stack. Debt (also referred to as leverage) is typically borrowed by sponsors from banks to acquire properties and fund business plans.

There are, in fact, various types of debt with distinct characteristics available to sponsors for real estate transactions.

Senior Debt in the Real Estate Capital Stack

The most common type of real estate debt is senior debt, which is secured – or collateralized – by a first lien mortgage on the property and has the highest priority of repayment over any additional financing in a transaction. A sponsor could use senior debt to acquire or develop a property.

Here are some typical features of senior debt:

- The senior debt holders, often a bank, are the first to be repaid.

- Senior debt is collateralized by the underlying property, meaning that the senior debt holders can foreclose on the property in the event of a default.

- Senior debt has the lowest risk of any type of loan in the real estate capital stack.

- Typically, senior debt has the lowest potential upside, as returns are capped by the interest rates charged by banks.

- Senior debt could be structured with fixed or floating interest rates.

Mezzanine Debt

Mezzanine debt is a type of loan that is subordinate to the senior debt, which means its debt service payments are received only after the senior debt is paid. Commercial real estate sponsors often obtain mezzanine loans when they want to add more leverage to a property by increasing borrowed loan proceeds in order to invest less equity.

Here are some typical features of mezzanine debt:

- The mezzanine debt holders are repaid prior to the equity investors.

- Mezzanine debt is secured by a pledge of the mezzanine borrower’s ownership interests in the property owner.

- The mezzanine debt holders can foreclose on the pledge of ownership interests in the property owner in the event of a default, and will then step into the shoes of the property owner, which includes being subject to the senior debt.

- Mezzanine debt could be structured with fixed or floating interest rates.

- Some mezzanine loans are structured with a portion of the interest being paid current, while the remainder accrues and is paid on the maturity date.

Mezzanine debt could have significant potential benefits for real estate transactions, such as:

- It limits the amount of required capital to acquire or develop a new property.

- It can increase levered returns since the property is acquired or developed with less out-of-pocket equity required from the equity investors.

- It can create liquidity by providing a “cash-out” of equity in an owned property.

Preferred Equity

Another type of financing that could be utilized for commercial real estate deals in conjunction with senior debt and common equity is preferred equity, which is typically thought of as a hybrid of debt and equity.

Preferred equity holders are paid a fixed return over a specific term. Similar to mezzanine debt, preferred equity isn’t secured by the underlying property. Instead, preferred equity holders may be able to take over the management, ownership and control of the entity that owns the underlying real estate away from common equity holders if certain defaults occur. Preferred equity carries lower risk than common equity due to its priority for repayment as well as potential recourse in the event of a default. However, preferred equity is subordinate to the rights of the senior debt and mezzanine debt.

Debt Product Types in the Commercial Real Estate Deal Lifecycle: Construction Debt, Bridge Debt, and Permanent Debt

Construction Debt

Construction Debt

- From pre-development to lease-up of new projects

- High interest rates with interest-only debt service

- Has short terms of 1 – 3 years

Bridge Debt

Bridge Debt

- From lease-up to stabilization of existing properties

- Mid to high interest rates with interest-only debt service

- Has short terms of 2 – 3 years

Permanent Debt

Permanent Debt

- Replaces existing debt on stabilized properties

- Low interest rates and could amortize or be interest-only debt service

- Has long terms of 5 – 10 years

Depending on where the commercial real estate deal is in its lifecycle or the investment strategy (which may be core, core-plus, opportunistic, and value-add), there are different types of debt products available.

Construction Financing

As its name suggests, construction financing is a type of debt product used for the ground-up development or significant repositioning of a commercial real estate property. Construction financing typically has short terms of one to three years and its proceeds are intended to cover the costs of planning, labor and materials to develop the property. It can also be used to acquire raw land. While the debt is secured by the underlying property, there is greater risk in the event the project is delayed or halted, and accordingly, construction loans have higher interest rates than loans made to acquire already-built assets.

Construction loans are funded through draws in which the lender releases funds as the project makes progress. The construction lender may also require that the equity in a deal is funded first before debt proceeds are funded. Construction loans typically have interest-only debt service payments, which means the principal isn’t paid down until the maturity date of the loan. This reduces the cash needed for debt service and allows the sponsor to focus available resources on completing the project and stabilizing the asset.

Bridge Loans

A bridge loan is another short-term debt product, and as its name suggests, is intended to bridge the gap between the acquisition or repositioning of a property through the time at which the property can secure longer term debt. A bridge loan term is typically two to three years, allowing the sponsor time to improve the performance of a property or increase operational efficiencies.

Upon execution of the business plan and stabilization of the property (i.e., the normal occupancy level has been reached), the sponsor can either sell the property or replace the bridge loan with permanent financing. Bridge loans typically have lower interest rates compared to construction loans, but higher interest rates compared to permanent loans, given the transitional nature of the underlying asset. Bridge loans can be structured as senior loans or mezzanine loans. Like construction loans, bridge loans typically have interest-only debt service payments.

Permanent Debt

Permanent debt is typically obtained upon stabilization of a property, and is the type of debt that replaces construction or bridge debt. Permanent debt is usually a senior loan with a lower interest rate and a five- to 10-year term. These loans inherently have lower risk because they are secured by fully developed and stabilized assets. Mezzanine financing can also be obtained behind a permanent senior loan secured by a stabilized asset. These mezzanine loans are typically viewed as having lower risk compared to mezzanine loans behind construction or bridge loans, given they are secured by a stabilized asset.

Investing in Debt Products

When seeking to invest in real estate, many people focus solely on making equity investments. Debt, however, is another avenue in which investors can gain a foothold in commercial real estate. While equity investments typically offer higher potential returns when compared to debt investments, this sometimes comes at the expense of increased risk. Certain debt products, such as mezzanine debt on fully developed and stabilized assets, may offer investors attractive risk-adjusted returns given their protected position in the capital stack.