There are many factors that institutional real estate investors consider when evaluating new deals.

One critical component is the rental demand of a given market, and one way to determine such demand is by performing a buy vs. rent analysis. This involves evaluating if the conditions of a specific geographic location are more conducive for residents to purchase a home or to rent a similarly styled and sized home in the same location.

The buy vs. rent analysis is especially appropriate for the single-family rental (SFR) and build-to-rent (BTR) space, because SFR/BTRs are targeting the same audience as owner-occupied single-family homes, which tend to include families in need of more space. As the SFR/BTR asset class continues to grow, it’s likely that more residents will compare the benefits of renting vs. purchasing a house in areas they desire to live.

What Constitutes a Buy vs. Rent Analysis?

The buy vs. rent analysis, which occurs during the underwriting of a deal, boils down to comparing the average costs of purchasing and owning a home in the same market as the subject rental property.

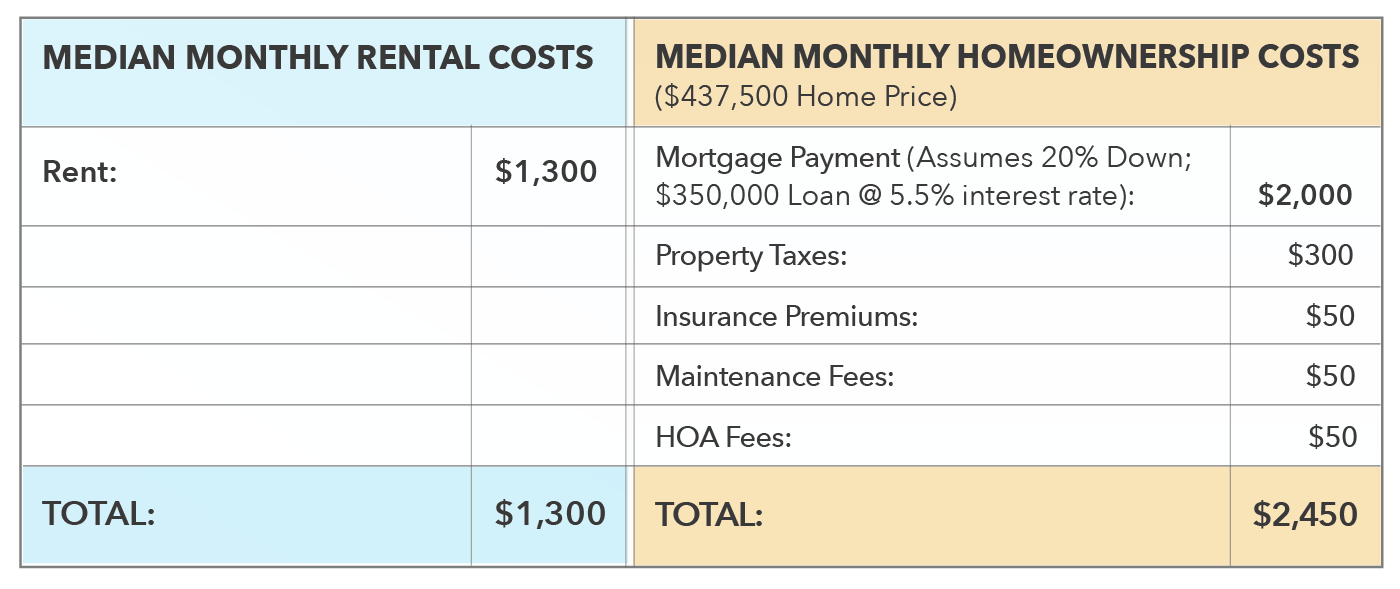

For rental properties, the primary cost factored in the analysis is the monthly rent. Non-reoccurring or non-essential expenses, such as security deposits, rental insurance, and pet fees, are typically not factored in the analysis.

Homeowners, on the other hand, have several expenses. The largest expense for homebuyers is a down payment. Most buyers (87% in 2021, according to the National Association of Realtors) purchase their homes with debt. The typical 20% lump sum down payment required to qualify for a traditional residential loan can be challenging, however, for many households.

To determine if residents in a certain area have the means to afford a 20% down payment, real estate underwriters will compare the median household income of an area with the median home sales price. Monthly expenses of homeownership include:

- Mortgage payments

- Property taxes

- Insurance premiums

- Maintenance/repair fees or common charges (usually in condos/co-ops)

- Homeowners association fee (HOA)

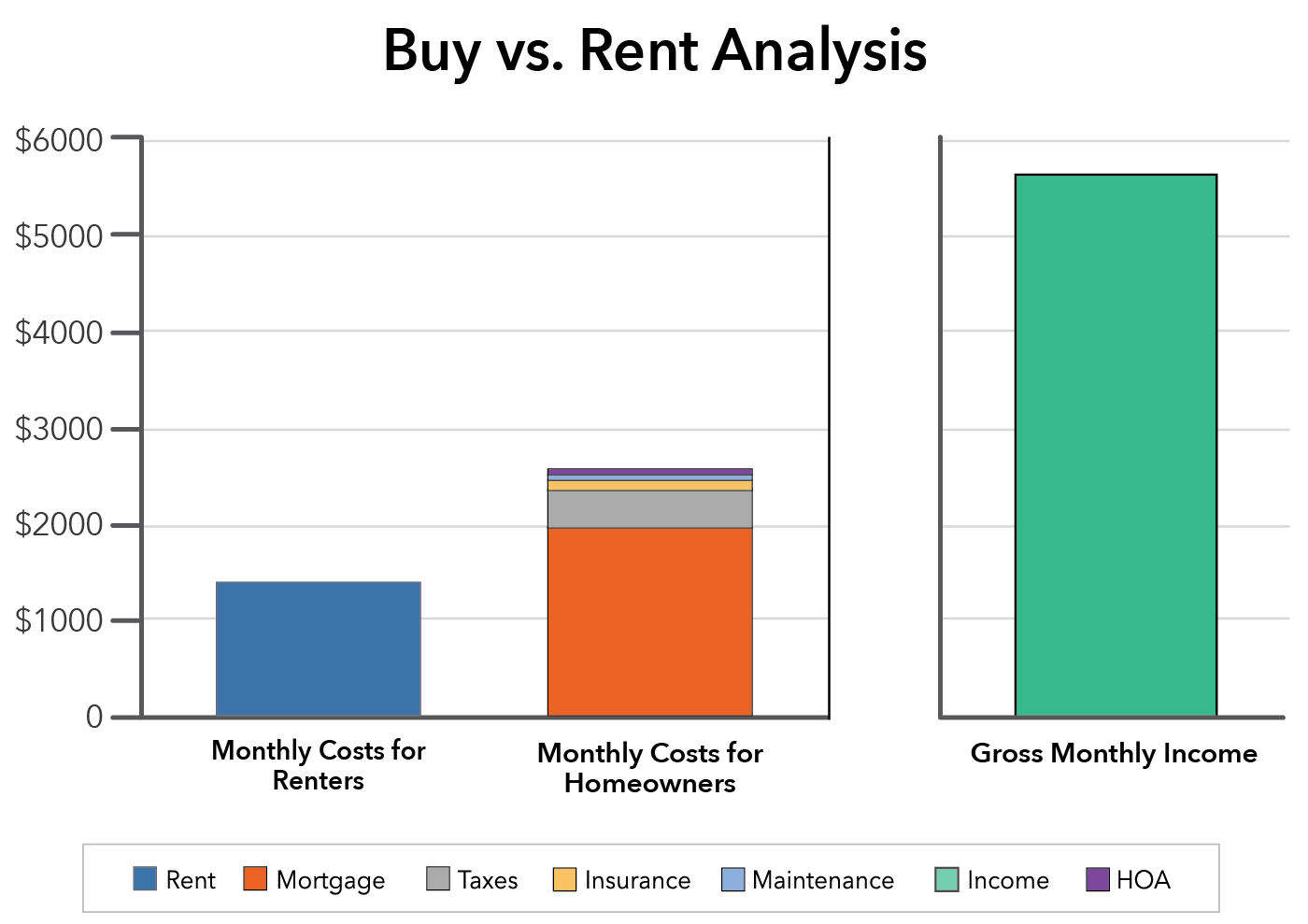

Utility fees are typically similar whether owning or renting a single-family home. If a home buyer chooses a down payment lower than 20%, they may also be required to pay a monthly private mortgage insurance (PMI) premium in addition to the costs listed above. Generally, 30% or less of a household’s gross monthly income is considered affordable. Therefore, by researching the average homeowner’s costs and the median household income of an area, one can establish if it is affordable or unaffordable for the typical household.

Here’s an example of a hypothetical buy vs. rent analysis comparing potential rental and homeownership costs in a market.

In this example, renting would result in monthly savings of $1,150, or $13,800 annually, potentially boosting rental demand in this area. Furthermore, as the gross monthly median household income of this area is approximately $5,700 (or $68,400 annually), the typical family would have to pay nearly 43% of their income if they purchased an average home in this market, making it unaffordable compared with approximately 23% of the monthly income necessary to rent a comparable home.

The Impact of Rising Inflation and Interest Rates on Rental and Homeownership Costs

Rental and homeowner expenses vary over time, and macroeconomic factors like rising inflation and interest rates can dramatically impact the costs associated with renting or buying.

Notably, rising interest rates may increase financing costs for homes secured by floating interest rate loans as well as new loans. Additionally, as inflation increases, so does projected homeowner expenses for products and services, such as maintenance, insurance and more. Equally, rents may also increase with inflation as multifamily property owners respond to rising expenses. A comprehensive buy vs. rent analysis will consider some or all of these variables.

The buy vs. rent analysis is a useful tool to gauge demand for rental units within a target market. When evaluating a deal for investment, especially in the SFR/BTR market, experienced investors will consider the desirability of not only comparable rental product, but also the local for-sale housing market.