It takes an enormous amount of effort to source, underwrite, fund, operate and ultimately sell large-scale real estate investments. These investments are typically acquired by different groups of investors — one group does all the aforementioned work, while the other usually comes to the table with the bulk of the required capital.

The former group is generally known as the managing member or general partner (GP), while the latter is generally known simply as a member or a limited partner (LP). While the exact title of each group is really dependent upon the legal structure of the investment entity, the industry has nonetheless favored usage of the terms general partner and limited partner to colloquially describe these groups.

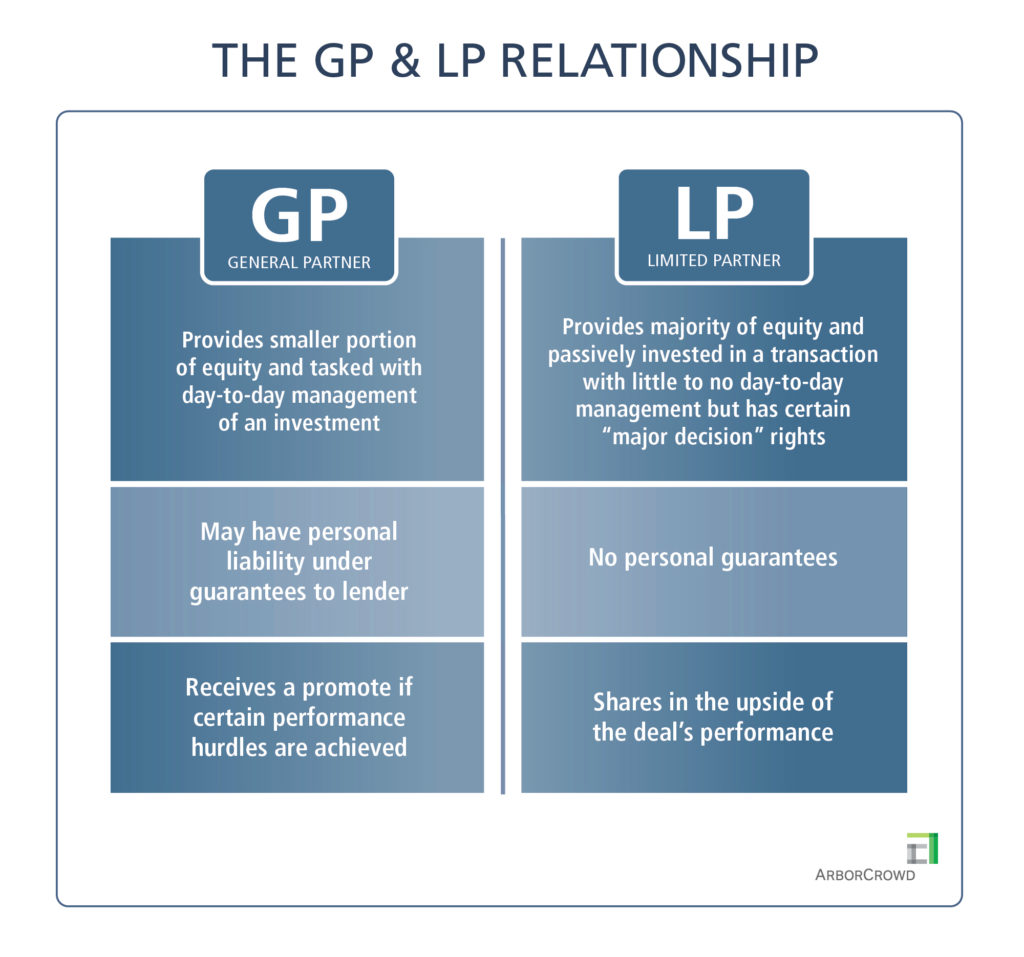

While these two categories of investors each own equity interest in a real estate investment, as noted above, they serve very different roles. When embarking on a deal, the GP and LPs enter into a joint venture (JV) agreement that defines their rights, roles, and responsibilities with respect to the transaction and also contains a “waterfall,” which determines how cash flows and distributions from the investment will be divided amongst them at different tiers of returns.

It’s important for investors to understand the relationship between the GP and LPs before making an investment, so they know how each side can potentially benefit from the transaction, and the risks they each may assume.

General Partners / Managing Members

General partners, often referred to as “sponsors” or “developers,” are individuals or entities that assume the day-to-day management and operational duties of a commercial real estate project. Therefore, investors expect the GP to have extensive experience in commercial real estate, as the success of the project depends on how well they execute decisions and navigate changing economic environments.

GPs often invest a smaller portion of the total equity required to fund a deal. However, they are tasked with identifying and underwriting deals, negotiating contracts, creating business plans, providing required tax documentation, obtaining local government approvals, securing financing, and controlling all other aspects of an investment and the eventual sale of the asset. GPs typically charge certain fees for their management roles to the JV or limited partners. As part of managing the transaction, they may hire firms to execute on certain tasks, such as:

- Contractors for construction or renovation work

- Architects and engineers for construction designs and specifications

- Property managers to oversee the maintenance and management of the property

- Brokers to lease units or market the property for sale

- Accounting firms to prepare tax statements

Most commercial real estate transactions include a significant portion of debt in the capital stack. When acquiring financing for a transaction, the GP (or one or more of its principals or guarantors) typically takes on personal liability if required by the lender, which adds a layer of risk for GPs that LPs do not share.

For their “sweat equity” and bearing additional risk, GPs may receive a “promote” or an outsized share of the returns relative to their investment if the deal is successful. This incentivizes sponsors to maximize the full return potential of the deal.

Limited Partners / Members

Limited partners, which can be non-institutional or institutional investors, typically don’t provide day-to-day management of an investment, but they contribute a majority of the equity in the deal.

Therefore, being a limited partner in a commercial real estate transaction could be more suited to investors who prefer to be passive, or those who lack sufficient commercial real estate experience. Their liability is reduced as LPs typically don’t have personal guarantees associated with debt financing like GPs. In some cases, the LPs do have “major decision” rights, which means that the GP needs the limited partners’ approval before certain actions can be taken.

Before a GP can earn a promote, LPs typically must receive a pre-determined return on their invested capital. However, during the hold period of a deal, plans may not go as expected due to macro or micro economic conditions or unforeseen circumstances. In those cases, if more equity is required for a capital expenditure or to maintain the liquidity of a project, GPs may issue a capital call to receive additional capital contributions from LPs.

GPs are investors that oversee all management and operational aspects of a commercial real estate investment, while LPs are generally passive investors with limited control that provide funding for an investment. Since LPs are depending on GPs to make critical decisions and successfully realize the investment, it’s of utmost importance that investors do their due diligence on sponsors and review their track records before partnering with them, especially during periods of heightened economic uncertainty. It is also important to ensure that a GP has enough of its own equity invested in a deal to ensure the GP’s and LP’s interests remain aligned.