What is Fixed Income from Real Estate Investments?

Fixed income is a set interest or coupon payment received from an investment on a regular schedule. In real estate, fixed income is typically derived from debt investments. Examples of real estate investments that can produce fixed income include:

- Senior Debt

- Mezzanine Debt

- Preferred Equity

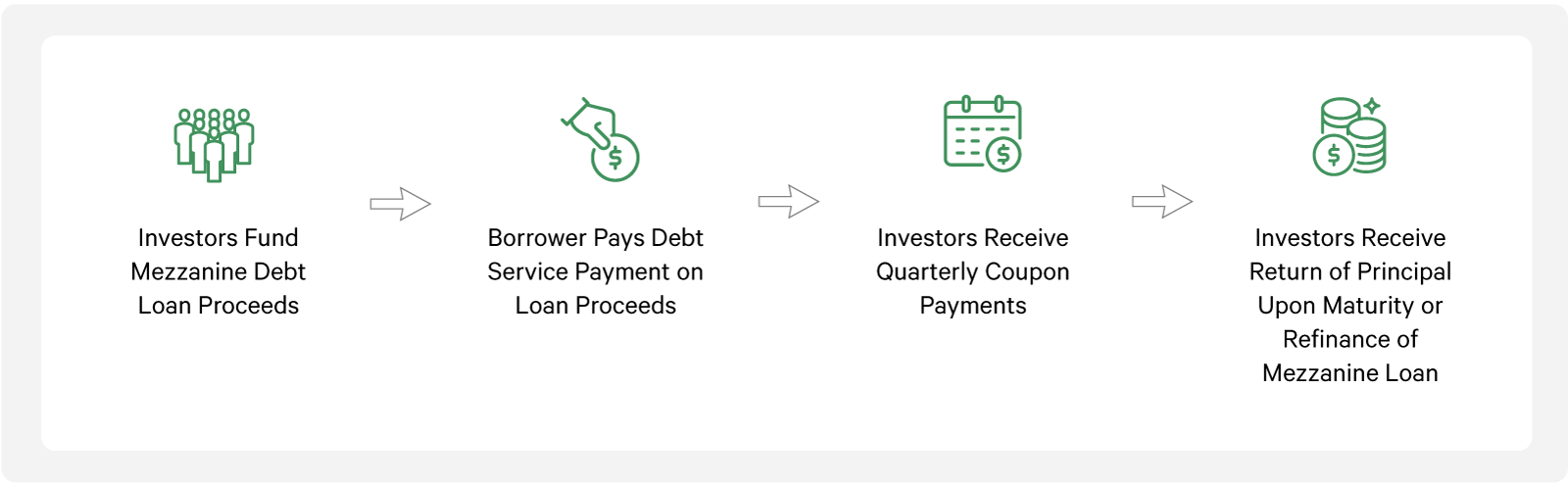

While these investments each have different risk and return profiles corresponding to their positions in the real estate capital stack, they all share certain commonalities. They each return investors’ principal upon a pre-determined maturity date, and typically pay quarterly coupons from interest payments received from borrowers who obtain the loans, providing stability and steady income.

What Makes Fixed-Income Investments in Real Estate Attractive?

Fixed-income investments in real estate, such as debt positions, can provide the following benefits:

- Exposure to real estate outside of common equity investments

- Reduce the impact that fluctuations in the performance of the underlying property can have on an investment

- Supplement lost or reduced income

- Preserve principal over the lifetime of a deal

While investors of all ages can benefit from fixed-income investments, there is a tendency for older investors to sometimes increase their holdings in fixed-income products. This is because, fixed-income investments allow more mature investors to supplement reduced or lost employment income due to partial or full retirement. Additionally, some fixed-income products, such as certain real estate debt, is collateralized and has priority of payment, reducing the risk of principal depletion at a time when investors may no longer be earning salaries.

How Fixed-Income Real Estate Investments Compare to Other Fixed-Income Investments?

Similar to fixed-income real estate investments, there are alternative investment vehicles in other financial sectors that can provide investors with fixed-interest payments or dividends on a pre-determined schedule. Some examples of these investments are:

- Corporate bonds

- Municipal bonds

- Treasury notes and bonds

- Certificate of deposits

- Annuities

- Preferred stocks

Much like knowing the institution or government issuing the bond helps investors analyze the risks and rewards of that product, knowing the experience and quality of the lender originating or servicing the debt product can help discern the risk-reward profile of the fixed-income real estate investment.

In real estate debt investments, however, in contrast to many other alternative investment vehicles, the risk of default by an underlying borrower is generally counterbalanced by having some form of collateral. In the case of a default on a senior loan, senior debt holders have the right to foreclose on the property directly. If there is a default on a mezzanine loan, mezzanine debt holders can foreclose and take control of the entity that owns the property from the mezzanine borrower, giving them the opportunity to cure the default and preserve their investments.

Fixed-income investments in real estate could provide steady income while reducing risk compared to common equity and other investment vehicles. It could also be an option to diversify a portfolio and provide exposure to the many burgeoning sectors in real estate.